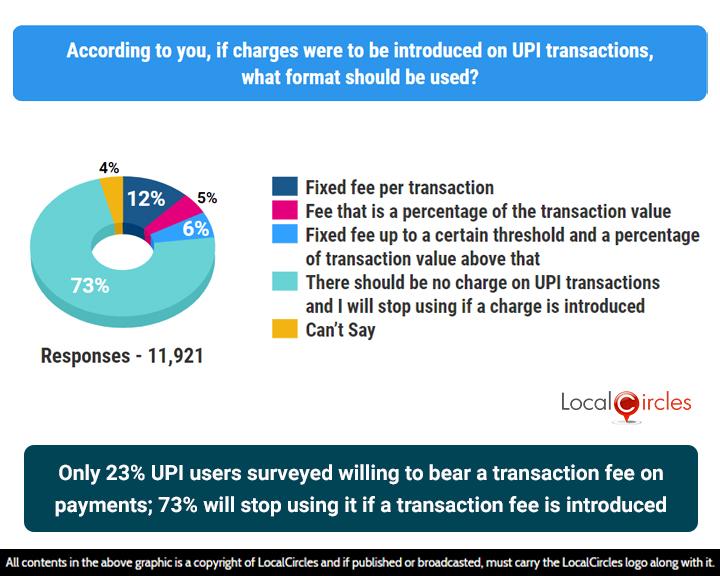

7 in 10 users surveyed not ready for a fee on UPI transactions

- ● Say will stop using UPI if transaction fee is levied regularly; 23% willing to pay a fee

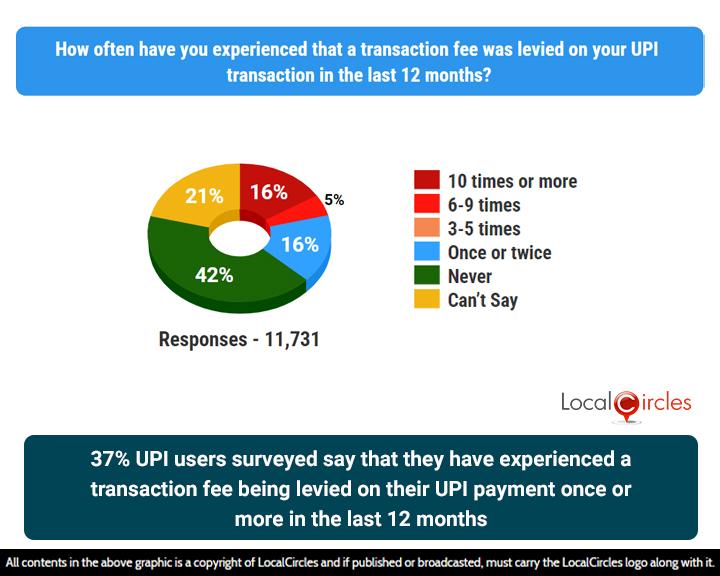

- ● 37% UPI users surveyed say they have been charged transaction fee once or more in the last 12 months

March 4, 2024, New Delhi: The United Payments Interface (UPI) transaction value reached INR 18.28 lakh crore in February 2024 with transactions per day increasing from 39.3 crore in January to 41.7 crore last month. This is despite the curbs put by RBI on Paytm, one of the top 3 platforms in the country for UPI transactions.

The Financial technology (fintech) companies last week raised the contentious issue of implementing a merchant discount rate (MDR) for Unified Payments Interface (UPI) transactions during an open house session with Finance Minister Nirmala Sitharaman. The MDR on UPI payments has been a longstanding demand from the fintech industry, asserting they don’t generate revenue from such transactions. MDR is the rate charged to a merchant for payment processing services on various payment instruments.

In August 2022, the Reserve Bank of India (RBI) released a discussion paper proposing a tiered structure charge on UPI payments based on different amount bands. Following the RBI discussion paper, the finance ministry clarified that there was no proposal to levy charges on UPI transactions. However, consumers from across India have been reporting some platforms charging a convenience or transaction fee for UPI payments. One of the most common example cited by consumers frequently is the INR 20 convenience fee levied by IRCTC for UPI payments. Several other payment gateways have also been reported to be charging a transaction fee for UPI transactions from merchants, some of who end up passing the same to the consumer.

Given the various consumer complaints related to platforms and merchants charging a transaction fee for UPI, LocalCircles conducted a survey to understand consumer experiences and views on the subject. The survey received over 34,000 responses from citizens located in over 364 districts of the country. 67% respondents were men while 33% respondents were women. 43% respondents were from tier 1, 33% from tier 2 and 24% respondents were from tier 3, 4 and rural districts.

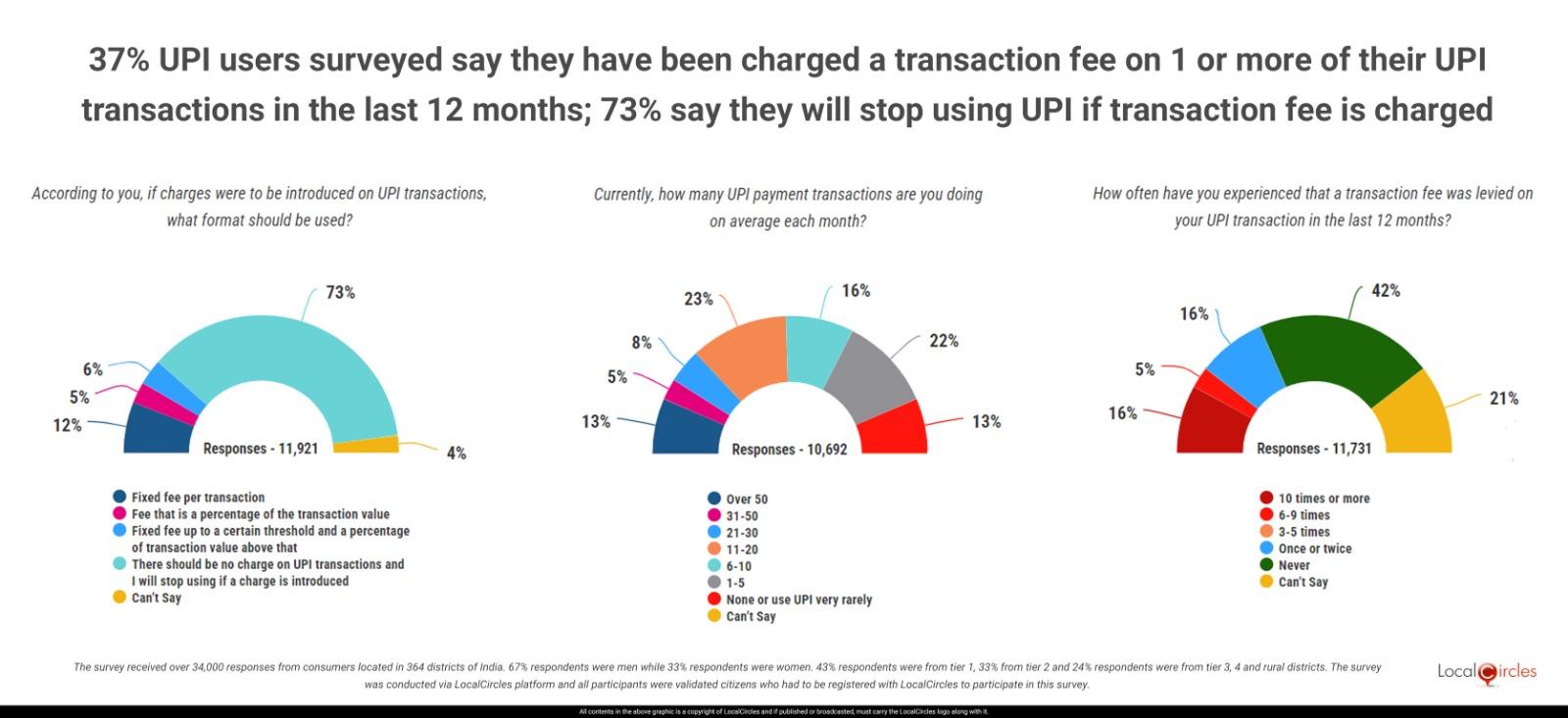

Only 23% UPI users surveyed willing to bear a transaction fee on payments; 73% say they will stop using UPI if transaction fee is charged

On the sensitive issue of transaction fee, the survey asked UPI users “If charges were to be introduced on UPI transactions, what format should be used”. The query received 11,921 responses with 73% indicating that they are opposed to any transaction fee being levied by UPI and stated that they “will stop using if a charge is introduced”. However, 12% of respondents seem to be open to paying a “fixed fee per transaction”; 5% are fine with paying a “percentage of the transaction value”, while another 6% preferred a “fixed fee up to a certain threshold and a percentage of transaction value above that”. The national survey showed that 4% of respondents were undecided on the issue that holds ramification for people who frequently use UPI for most payments including personal and professional transactions. To sum up, only 23% of UPI users surveyed are willing to bear a transaction fee on payment; 73% of those surveyed indicated that they will stop using UPI if a transaction fee is introduced.

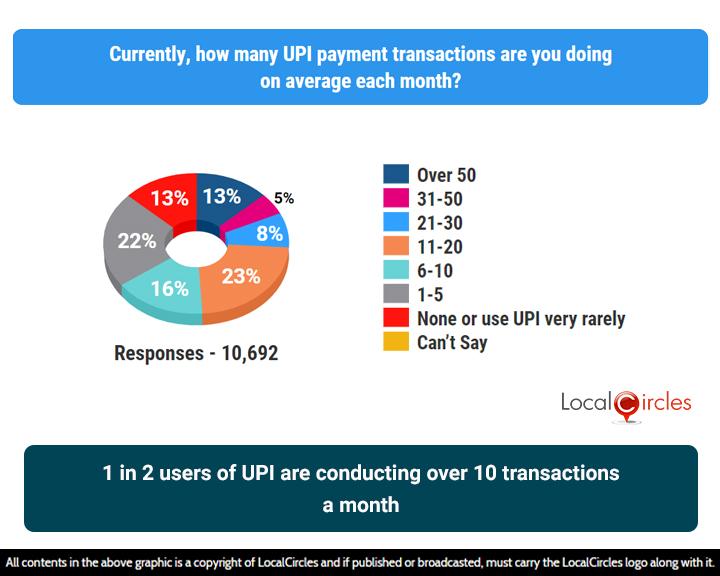

1 in 2 UPI users surveyed confirm conducting over 10 transactions a month

To gauge how frequently UPI is being used, the survey next asked UPI users, “How many UPI payment transactions are you doing on an average each month?” The survey revealed 23% of respondents did 11-20 transactions, while 22% did between one to five transactions and another 16% depended on UPI for 6-10 transactions. Of the remaining 13% did more than 50 transactions every month, 5% around 31-50 transactions and 8% between 21-30 transactions on an average every month. In all, 87% of the 10,692 UPI users responding confirmed utilizing UPI platforms to carry out transactions each month, out of which 1 in 2 UPI users are conducting over 10 transactions every month.

37% of UPI users surveyed claim that they have experienced a transaction fee being levied on their UPI payment once or more in the last 12 months.

Following up on some of the complaints voiced by UPI users, the survey next asked UPI users, “How often have you experienced that a transaction fee was levied on your UPI transaction in the last 12 months?” The query received 11,731 responses with 16% of respondents indicating “10 times or more”; 5% of respondents indicated “6-9 times”; 16% indicated “once or twice”. However, 42% of those surveyed indicated “never” and 21% of respondents were not sure and opted for “can’t say”. The data shows 37% of UPI users surveyed claim that they have experienced a transaction fee being levied on their UPI payment once or more in the last 12 months.

In summary, an increasing number of citizens are taking to UPI to make consumer to consumer and consumer to merchant payments. Whether it is paying the vegetable vendor or paying a hotel bill, Indians are scanning the UPI QR code and making their payments. The survey finds that one of the key reasons majority have taken to UPI is because of the zero transaction fee and if a fee were to be introduced, many will reduce usage of UPI or stop using it depending on the fee. The survey also finds that some platforms or merchants are levying a convenience or transaction fee for UPI transactions with 37% UPI users surveyed saying that they have had one or more such instance in the last 12 months.

LocalCircles will escalate the findings of this study to Ministry of Finance and the RBI so that they are aware of the consumer experience and view on the subject and can drive the necessary intervention, so UPI continues to be the primary platform for digital payments in India.

Survey Demographics

The survey received over 34,000 responses from citizens located in over 364 districts of the country. 67% respondents were men while 33% respondents were women. 43% respondents were from tier 1, 33% from tier 2 and 24% respondents were from tier 3, 4 and rural districts. The survey was conducted via LocalCircles platform and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

Also Featured In:

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well

)