84% app taxi consumers surveyed claim drivers are still cancelling rides upon finding out destination or digital payment mode; Situation has worsened in last 24 months

- ● Drivers cancelling rides, surge pricing and long waiting times are top issues faced by consumers

- ● 70% consumers surveyed claim Government notices on unfair practices have had no impact

- ● 82% consumers keen Government should frame basic common standards for taxi aggregators for improving consumer experience

January 16, 2024, New Delhi: It is difficult to say as yet whether rising competition in the app-based taxi services segment in India with several new entrants is making a difference in consumers’ experience as many of the new players are yet to expand their reach across the country. Nonetheless, the presence of multiple new players including BluSmart, inDrive, Rapido, etc., in addition to the established Ola and Uber is helping consumers have more choice when they need a ride.

Attempt by the state-run Open Network for Digital Commerce (ONDC) to create a network of last-mile service providers to make travel seamless for commuters moving within cities, is also making a small difference. Several apps offering services of auto-rickshaws and taxis not linked with any of the established companies are coming up in cities like Bengaluru, taking advantage of ONDC’s policy of not charging any commissions. This is also working towards creating more choice for commuters.

LocalCircles first raised the consumers’ concerns with app taxi aggregators in 2019 with the Ministry of Road Transport and Highways (MoRTH) following which the Government in November 2020 brought the Motor Vehicle Aggregator Guidelines, which among other directives capped the surge pricing at 1.5 times higher than the base fare, and also introduced cancellation penalty for drivers at 10% of fare capped at INR 100. The guidelines have however not been operationalized by most states thereby leading to continued consumer grievances.

The convenience of having the option of app based taxi services in many cities is undeniable as it has provided for market competition and an alternative to using your own vehicle. However, it has also become a headache for consumers due to an increasing number of last minute cancellations of rides by drivers not wanting to go to a particular destination or not wanting to accept digital payment, surge pricing and rude behaviour of drivers. A survey by LocalCircles in April 2022 revealed that 71% of app taxi users were still facing ride cancellation issues. In May 2022, after the LocalCircles survey was released, the consumer regulator CCPA issued notices to some of the platforms on Unfair Trade Practices but that too has had limited impact on the ride cancellation front. So far, only the Delhi government has come out with a draft cab policy. It has however not prevented ride cancellation by drivers. Based on inputs from both platforms and drivers, there are no disincentives or penalties in place for drivers who cancel rides.

Given the continued complaint flow on app-based taxi aggregators, LocalCircles decided to conduct another national survey to find out if anything has changed on the ground for the consumers. The survey received over 44,000 responses from app taxi consumers located in 276 districts of India. 64% respondents were men while 36% respondents were women. 41% respondents were from tier 1, 36% from tier 2 and 23% respondents were from tier 3, 4 and rural districts.

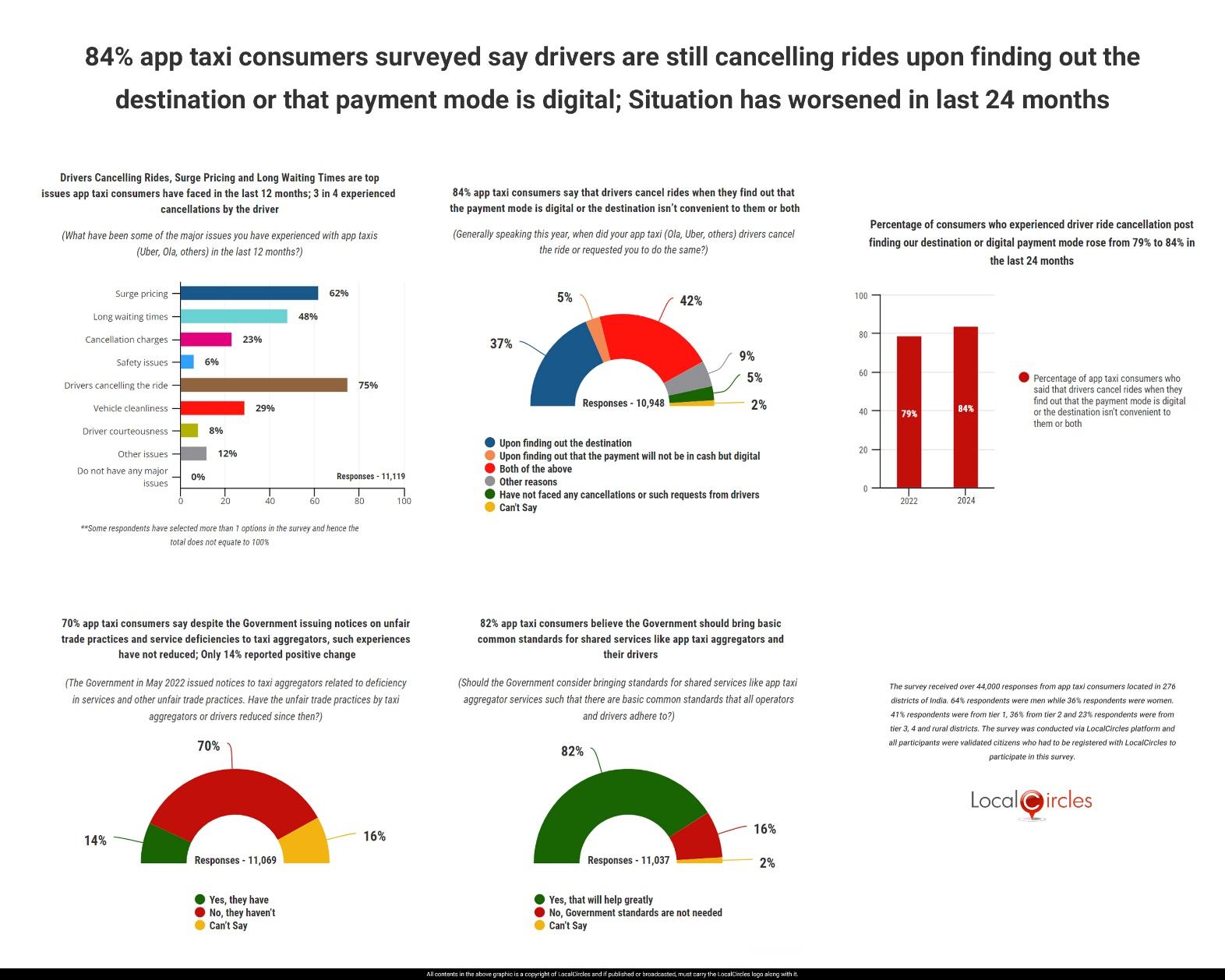

Drivers cancelling rides, surge pricing and long waiting times are the top issues app taxi consumers have faced in the last 12 months

Experience of taking app-based taxi service varies from city to city. The first question in the survey asked respondents, “What have been some of the major issues you have experienced with app taxis in the last 12 months?” to which 3 out of 4 respondents indicated “drivers cancelling the ride”. Some among the 11,119 respondents to this query indicated more than one reason. Thus, 62% indicated “surge pricing”, 48% long waiting time, 29% “vehicle cleanliness”, 23% “cancellation charges”, 8% driver “courteousness”, 6% indicated “safety issues”, and 12% other unspecified issues. The response clearly illustrates that almost all the issues the 2020 motor vehicle aggregator guidelines sought to address have remained unaddressed. The data shows drivers cancelling rides, surge pricing and long waiting times are the top issues app taxi consumers have faced in the last 12 months; 3 in 4 consumers experienced cancellation by the driver.

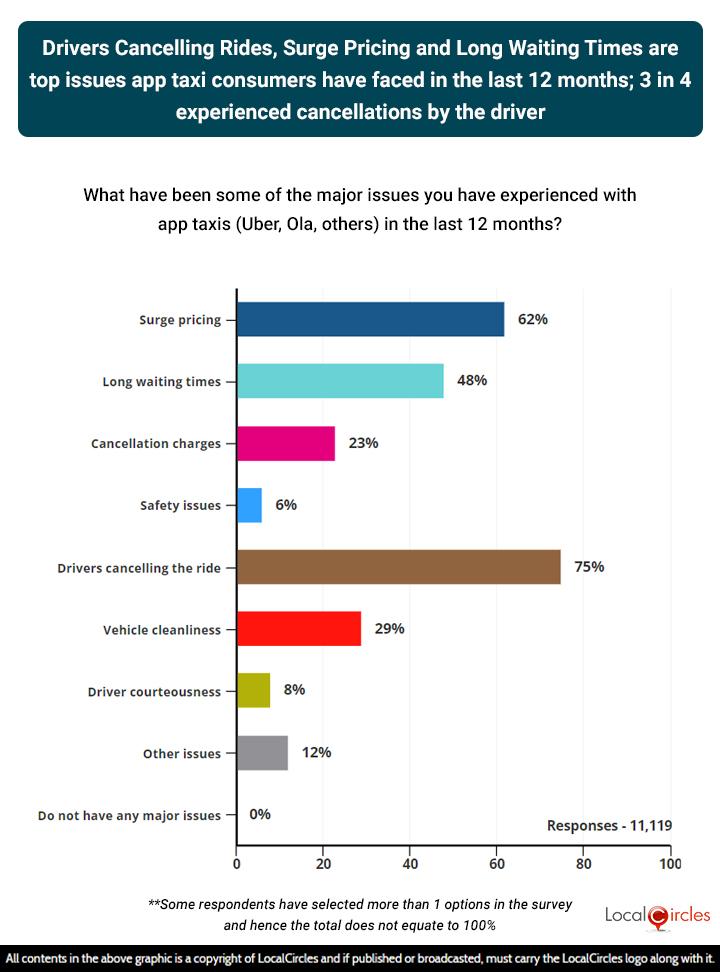

84% of respondents have faced cancellations either due to destination or due to not wanting to pay in cash or both the reasons

Focusing on the top reason for consumer disappointment, the survey next asked respondents, “When did your app taxi drivers cancel the ride or requested you to do the same?”. Out of 10,948 respondents to this query, 37% indicated “upon finding out the destination”; 5% “upon finding out that the payment will not be in cash but digital”; 42% cited both the earlier reasons; and 9% other reasons. In aggregate, 84% of respondents have faced cancellations either due to destination or due to not wanting to pay in cash or both the reasons, while only 5% stated that they had not faced any problems and 2% did not give any clear reason.

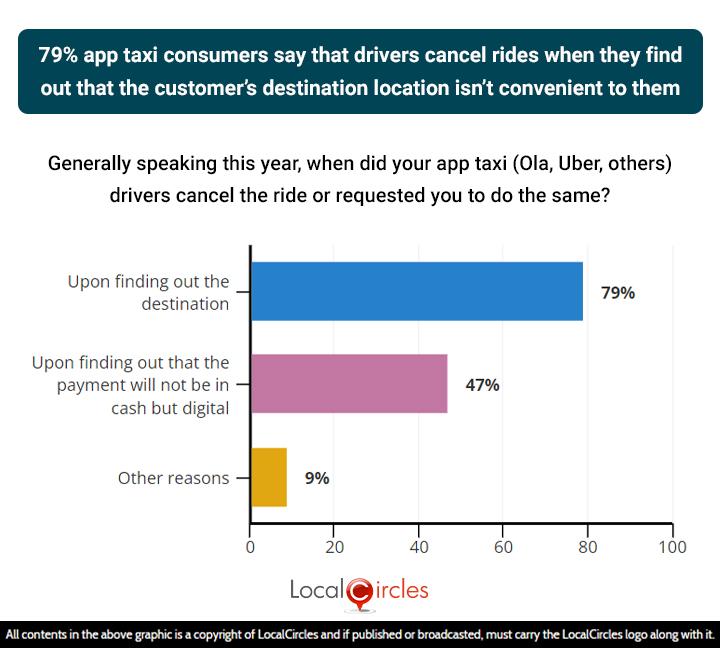

To the question “When did your app taxi drivers cancel the ride or requested you to do the same” the data shows that this year 79% did so “upon finding out the destination”; 47% faced the problem “upon finding out that the payment will not be in cash but digital”; and 9% indicated unspecified reasons.

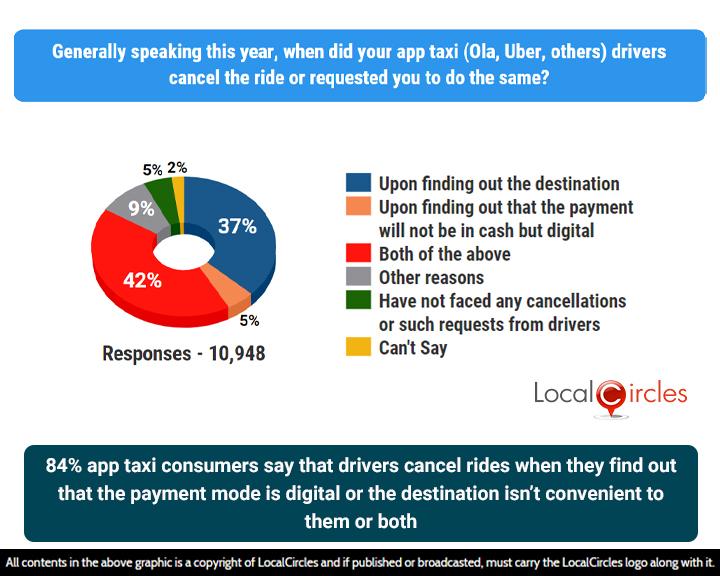

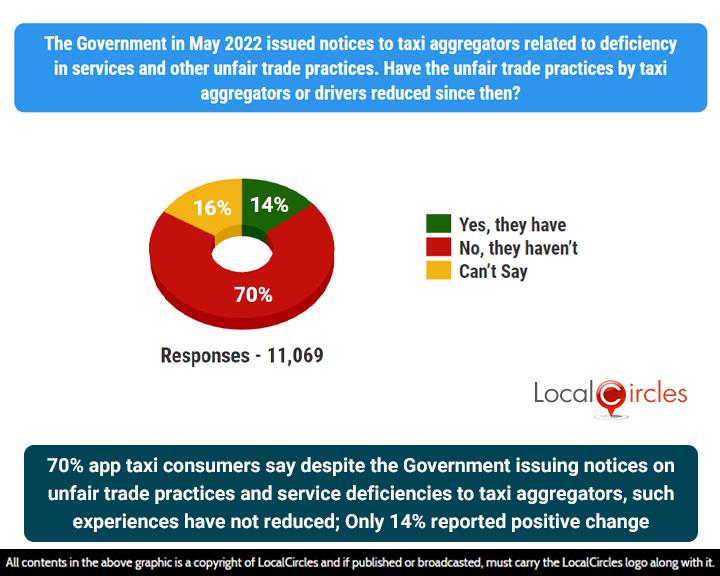

70% app taxi consumers say despite the government issuing notices on the unfair trade practices and service deficiencies to taxi aggregators, such experiences have not reduced

The survey next asked “The government in May 2022 issued notices to taxi aggregators related to deficiency in services and other unfair trade practices. Have the unfair trade practices by taxi aggregators or drivers reduced since then?” Out of 11,069 respondents who responded to this question, majority or 70% stated “no, they haven’t” while 14% felt there has been positive change and 16% gave no clear response. In sum, 70% app taxi consumers say despite the government issuing notices on the unfair trade practices and service deficiencies to taxi aggregators, such experiences have not reduced. Only 14% of respondents have reported positive change which per the community discussion were mostly in the area of surge pricing reduction.

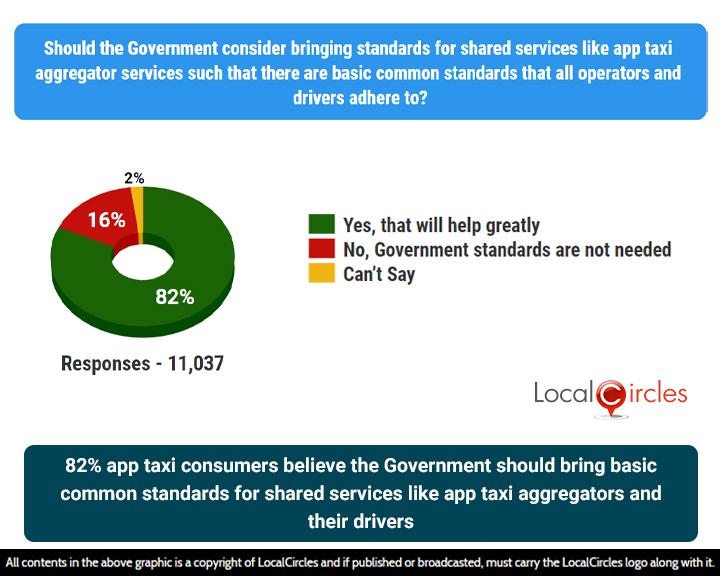

82% app taxi consumers desire that the government should bring basic common standards for shared services like taxi aggregators

Considering the lack of improvement in services by the app taxi aggregators, the survey next asked “Should the government consider bringing standards for shared services like app taxi aggregators services such that there are basic common standards that all operators and drivers adhere to?” Over 11,000 responded to this query with 82% app taxi consumers desiring that the government should bring basic common standards for shared services like app taxi aggregators and their drivers; 16% felt “government standards are not needed” and 2% were uncertain on the issue. As new taxi aggregators like Rapido, BluSmart, Indrive and some regional ones expand operations, a set of common standards can help improve the consumer experience.

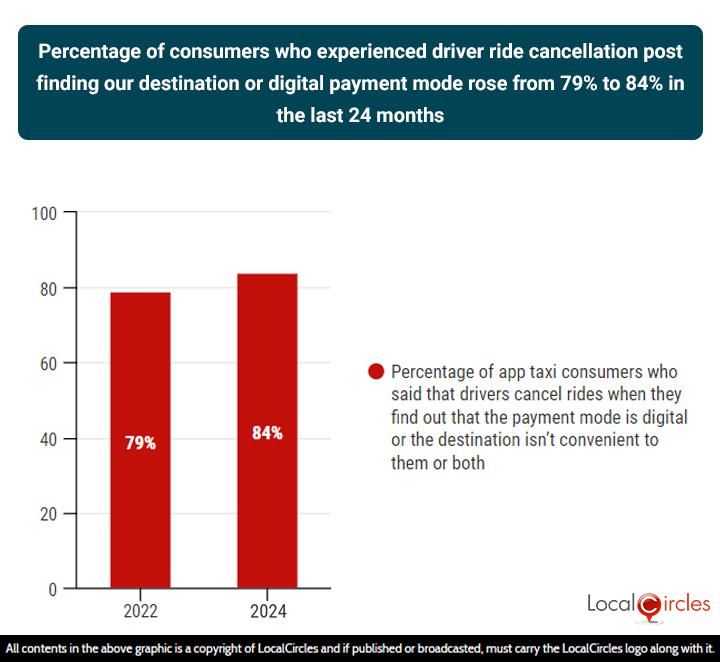

What is also noteworthy is that in comparison to 2022 survey result which indicated that 79% of app taxi consumers complained that drivers cancel rides when they find out that the payment mode is digital or the destination isn’t convenient to them or both, currently such complaints are shared by 84% consumers. It appears more the demand, given the higher traffic with things normalizing, the worse are the experiences of consumers.

In summary, the survey learns that consumers using app taxis continue to face the same issues they were experiencing in 2019, i.e. prior to the Motor Vehicle Aggregator rules 2020, and 75% of those surveyed had the experience of drivers cancelling rides on them in just the last 12 months. 62% of them reported experiencing surge pricing issues while 48% of them reported long waiting times. 82% of those who experienced drivers cancelling rides said they did that because the payment mode was digital or the destination wasn’t convenient to them. When asked about the effectiveness of actions taken post 2022 when the taxi aggregators were issued notices by the CCPA, 7 in 10 app taxi consumers reported no positive change. Only 14% reported some improvement, primarily in the area of surge pricing. 82% app taxi consumers surveyed were also in favour of Government bringing basic common standards for shared services like app taxi aggregators. The survey points to need for some very clear actions by both the taxi aggregator platforms and the Government which can help improve consumers’ experience and trust. With three years gone by since the Motor Vehicle Aggregator Rules were issued and no material change on the ground for the consumer, the time for action is now.

Survey Demographics

The survey received over 44,000 responses from app taxi consumers located in 276 districts of India. 64% respondents were men while 36% respondents were women. 41% respondents were from tier 1, 36% from tier 2 and 23% respondents were from tier 3, 4 and rural districts. The survey was conducted via LocalCircles platform and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

Also Featured In:

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.