84 percent of those surveyed think laundering was common place post demonetisation

Highlights

- • Citizens suggest various inputs to minimize impact of laundering

- • Most say impose withdrawal limitations and examine transaction patterns in comparison to previous years and months

- • Also suggest investigating transactions related to farm supply chain, jewellers, share assignments

December 03, 2016, New Delhi: The demonetisation exercise began on Nov 8th 2016 when the 500 and 1000 rupee notes were abolished and deemed acceptable only at a select few places. After seeing many examples raised by citizens in the Fight Corruption Circle on LocalCircles, India’s leading community engagement platform, a poll was conducted to gauge how common place was money laundering.

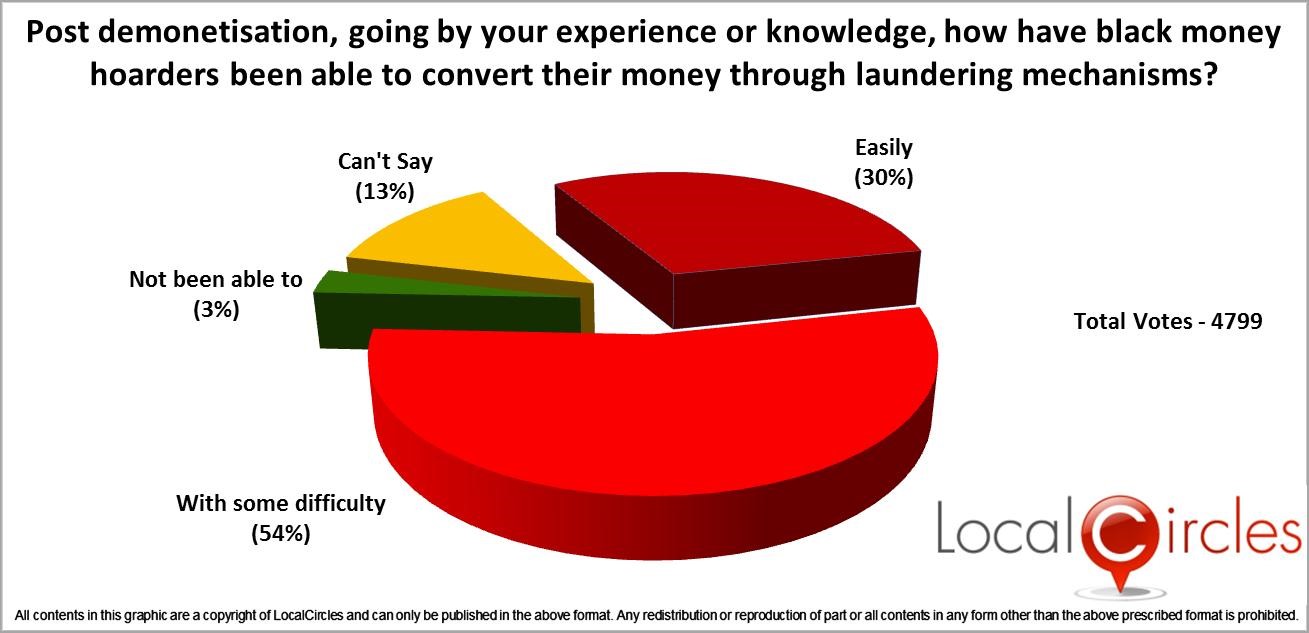

In this poll conducted by LocalCircles over 3 days, citizens were asked whether they had direct experience or knowledge of money laundering activities taking place. 30 per cent of the citizens said it was easy to launder money while 54 per cent of them said it was being done but with some difficulty. Only 3 per cent citizens said laundering was not happening while 13% did not have an opinion.

Per RBI and bank reports, deposits exceeding over 11 lakh crores in 500 and 1000 rupee notes have been received by bank and the total currency value of old 500 and 1000 rupee notes stands at 14.2 lakh crores. In a related LocalCircles poll concluded on Nov 29th, 28% citizens said that they are yet to deposit their old currency in the bank. If the poll results were to be applied to the total oustanding currency, the projected number may get close to the 14.5 lakh crore number. If the same were to come true, it may indicate that the entire black money in the system has been laundered thereby raising question on the effectiveness of the demonetisation scheme as the mechanism to fight black money.

Looking at that eventuality, over 60,000 LocalCircles members in the Fight Corruption circle operated in association with Transparency International India have given inputs on what steps must be taken to address laundering and to ensure those who have laundered money get caught. Suggestions include imposing amonthly withdrawal limit of the higher of average balance (between Nov 15-Oct 16) or Rupees 10,000 for the next six months to cases where deposits in Nov-Dec 2016 are drastically higher than transaction in previous months and years. Citizens have also suggested that accounts of various constituents in the farm supply chain, back dated sales of jewellers and property registration transactions with incomplete details be scrutinized. Suggestions have also been made to review any share assignments in companies in the Nov 16 – March 17 period while there is no corresponding e-transfer/cheque transaction. Citizens are also saying that last minute travel during week of Nov 8, phone logs of bank managers, practiccing chartered accountants should also be reviewed for unusual activity.

Below are the key recommendations by citizens to address money laundering

- 1. For next 6 months, all accounts should have a monthly withdrawal limit of higher of Rupees 10,000 or average balance (between Nov 15-Oct 16)

- 2. All accounts with deposits above Rupees 2.5 lakhs in Nov-Dec 16 where the average cash deposit in previous years was significantly lower than Nov-Dec 16 deposits must be investigated

- 3. All property registration records from April – Dec 16 should be reviewed and missing details like Aadhar or Pan Card added to them

- 4. Jan Dhan accounts with large activities only in Nov-Dec 16 should be thoroughly checked

- 5. All farmers who have taken loans but have deposited cash into their accounts should be investigated

- 6. All Nov-Dec RTGS transactions done by grain traders, distributors, mill owners and farmers must be compared to previous years and investigated if they look unusual

- 7. Any deposits in the account of non-tax paying low income person in the range of Rs. 10,000 to Rs.2.5 lakh must be investigated as these people might have been provided cash by their employer

- 8. Any employer whose monthly payroll transfer amounts have drastically reduced starting Dec 16 should be investigated as they may have paid future advance salaries in cash

- 9. Bank Accounts with unusual activity as a percent of previous year’s average should be investigated

- 10. CCTV footage of banks where there is a massive cash exchange should be archived and audited

- 11. Exchanges done under each AADHAR/PAN card should be consolidated through the system and checked

- 12. Companies reporting share assignments in the months of Nov 16-March 17 without a corresponding e-transfer or cheque transaction should be thoroughly scrutinized

- 13. Jeweller transactions from April 1st 2016 till Nov 30th 2016 should be reviewed in detail and compared to previous year patterns for back dated sales

- 14. Last minute travel that was ticketed for cash and took place between Nov 9-16 should be checked

- 15. Nov-Dec 16 Call records of all bank managers, practicing chartered accountants should be checked

- 16. Petrol pumps which have made large payments for purchase of oil in advance should be scrutinised

- 17. Dormant accounts that have suddenly received big cash deposits should be investigated

- 18. Accounts of temples and trusts should be checked for inconsistencies

- 19. NGOs whose accounts have shown a sudden spike in transactions in the months of Nov-Dec should be investigated.

Poll to gauge the extent of money laundering

About LocalCircles

LocalCircles takes Social Media to the next level and makes it about Communities, Governance and Utility. It enables citizens to connect with communities for most aspects of urban daily life like Neighborhood, Constituency, City, Government, Causes, Interests and Needs, seek information/assistance when needed, come together for various initiatives and improve their urban daily life. LocalCircles is free for citizens and always will be!

K Yatish Rajawat- media@localcircles.com, +91-9818311177

About Transparency International India

Transparency International India (TII) is a non-government, non-party and not-for-profit civil society organization of Indian citizens with professional, social, industrial or academic experience seeking to promote transparent and ethical governance and to eradicate corruption.

Rama Nath Jha - +91-9312961506