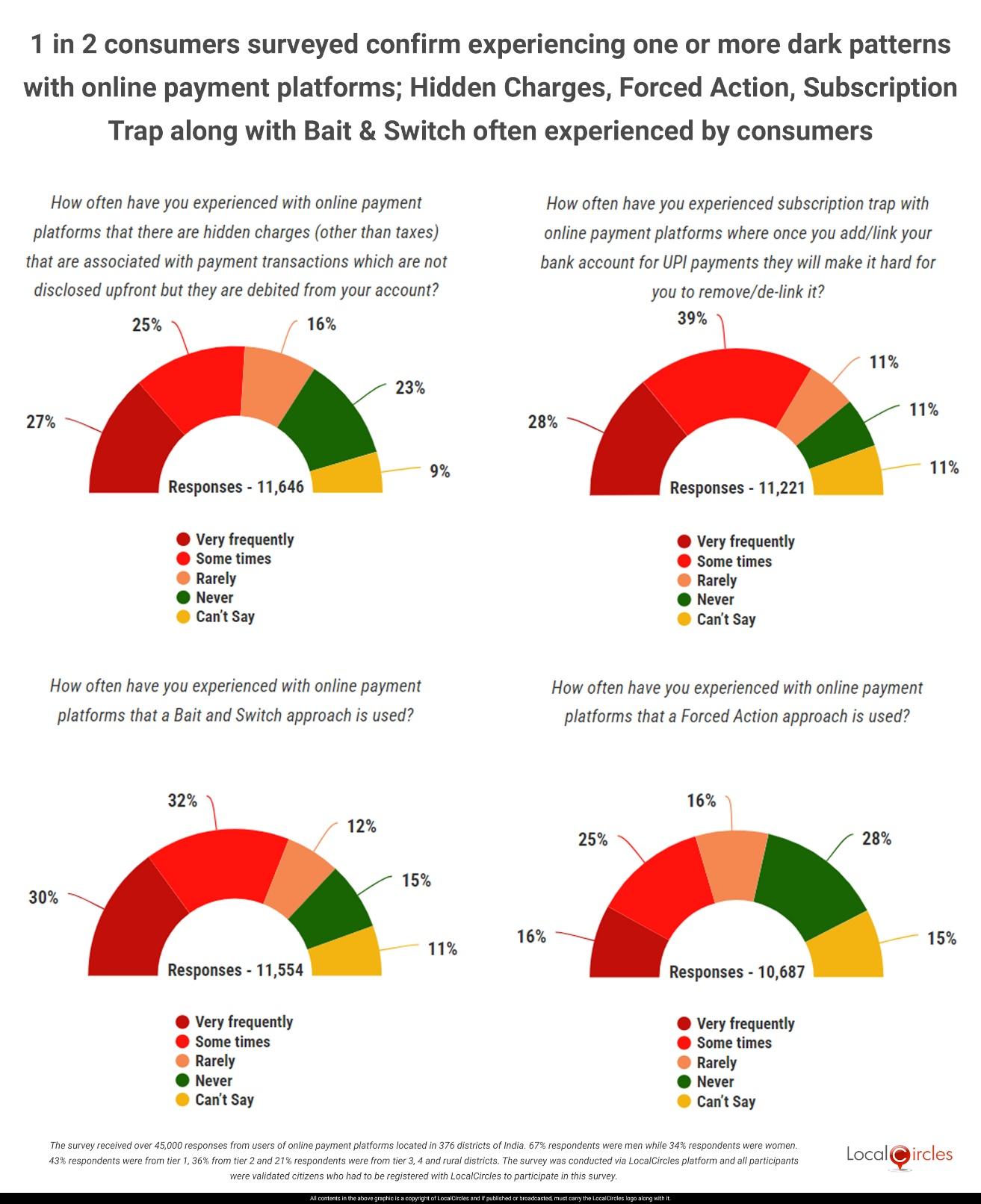

1 in 2 consumers surveyed confirm experiencing one or more dark patterns with online payment platforms; Hidden Charges, Forced Action, Subscription Trap along with Bait & Switch often experienced by consumers

- ● 52% of respondents have found Hidden Charges to be associated with payment transactions

- ● 67% users of online payment platforms surveyed have experienced Subscription Trap

- ● 62% respondents have experienced Bait and Switch approach where a cashback was advertised to lure them but never actually paid

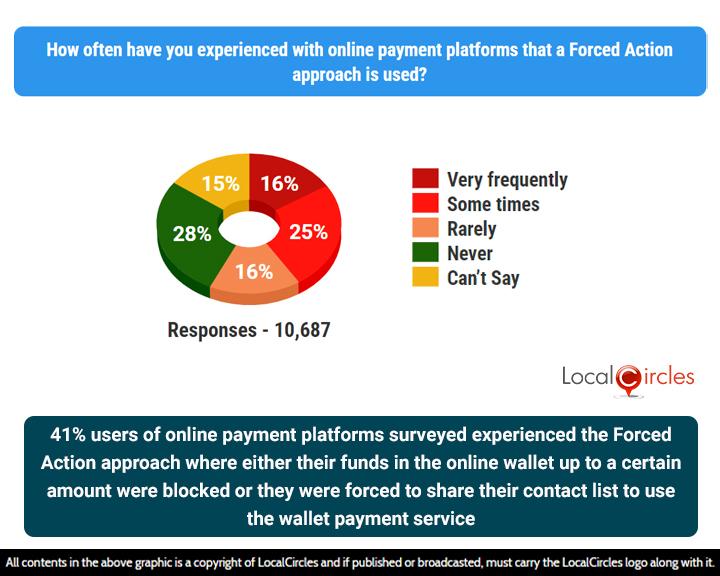

- ● 41% respondents admitted that they experienced the Forced Action approach

April 10, 2024, New Delhi: Digital payments through downloaded apps have now become a part of day-to-day lives of Indians. From paying wayside vendors to making purchases at the local stores to recharging phones, booking tickets, millions use UPI (Unified Payments Interface) payments. With many Indians using these platforms, complaints about manipulate practices, ones by design and ones that are perceived have also risen. The manipulative practices used by platforms have been called out as dark patterns by the Government of India.

The Government via the Central Consumer Protection Authority (CCPA) has identified 13 types of dark patterns which include false urgency, basket sneaking, confirm shaming, forced action, subscription trap, interface interference, bait and switch, drip pricing, disguised advertisement, nagging, trick questions, SaaS (software as a service) billing and rogue malwares. Per the CCPA notification, dark patterns amount to misleading advertisement or unfair trade practice or violation of consumer rights.

Since the Government notification banning use of dark patterns came out, some consumers have been complaining about instances as they go about their usage of these platforms. Instead of going by the anecdotes, LocalCircles decided to conduct a national survey to gauge what are the dark patterns that consumers using digital payments are facing. The survey received over 45,000 responses from users of online payment platforms located in 376 districts of India. 67% respondents were men while 33% respondents were women. 43% respondents were from tier 1, 36% from tier 2 and 21% respondents were from tier 3, 4 and rural districts.

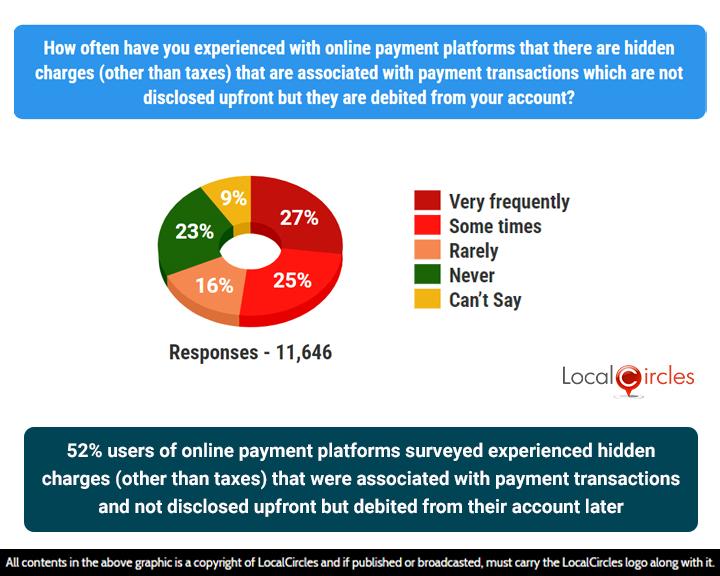

52% users of online payment platforms surveyed have experienced hidden charges are associated with payment transactions and not disclosed upfront but are debited from their account later

Hidden charges when topping up the payment wallet is an often-voiced complaint. The survey asked, “How often have you experienced with online payment platforms that there are hidden charges (other than taxes) that are associated with payment transactions which are not disclosed upfront but are debited from your account?” The query received 11,646 responses with 27% of respondents indicating “very frequently”; 25% indicating “sometimes” and 16% indicating “rarely”. However, 23% of respondents stated that they have “never” faced hidden charges and 9% of respondents did not give a clear response. To sum up, 52% users of online payment platforms surveyed have experienced hidden charges (other than taxes) that are associated with payment transactions and not disclosed upfront but are debited from their account later.

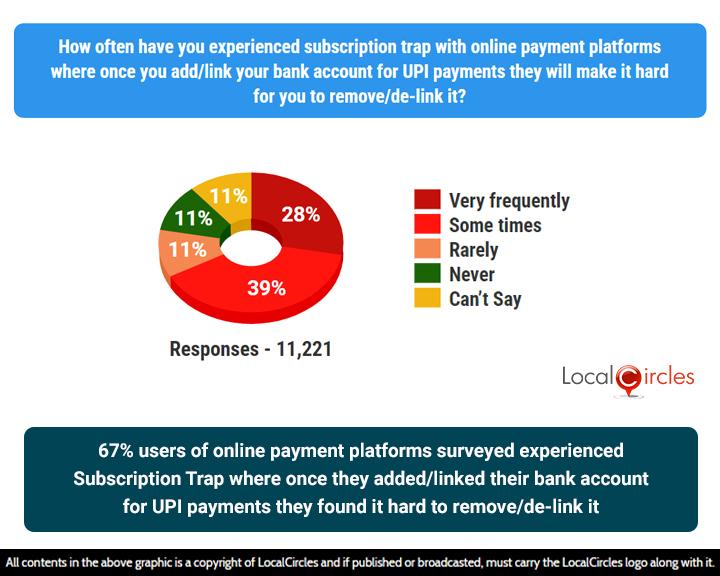

67% users of online payment platforms surveyed have experienced Subscription Traps where once they added/ linked their bank account for UPI payments they found it hard to remove/ delink it

Subscription trap, a dark pattern wherein the bank account is added but difficult to stop, is another malpractice that is associated with online payment platforms. Despite safeguards put in place by the RBI it continues. The survey asked, “How often have you experienced a subscription trap with online payment platforms where once you add/ link your bank account for UPI payments they will make it hard for you to remove/ delink it?” The query received 11,221 responses with 28% of those surveyed indicating “very frequently”; 39% indicating “sometimes” and 11% indicating “rarely”. Of the remaining respondents, 11% stated they have “never” faced this problem and 11% of respondents did not give a clear response. To sum up, 67% users of online payment platforms surveyed have experienced Subscription Traps where once they added/ linked their bank account for UPI payments they found it hard to remove/ delink it.

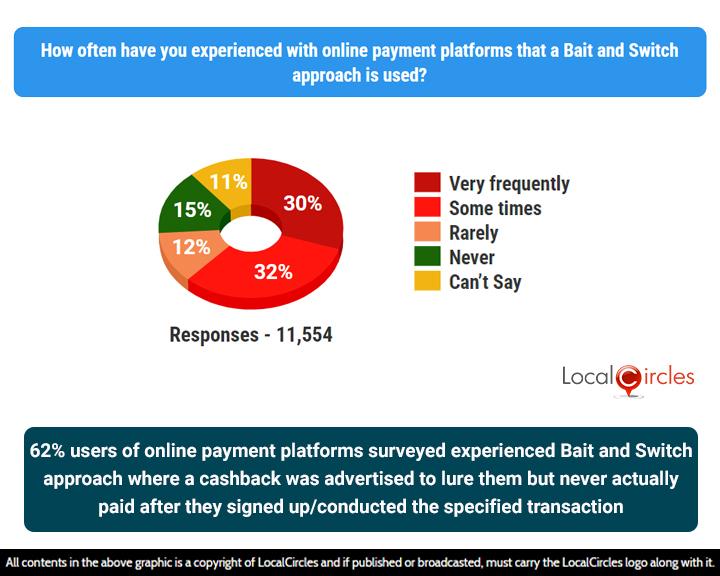

62% users of online payment platforms surveyed experienced Bait and Switch approach where a cashback was advertised to lure them but never actually paid after they signed up/ conducted the specified transaction

Another dark pattern noticed on some online payment platforms is Bait and Switch under which the users are offered a cashback scheme for making extra transactions or adding more money to the wallet but never paid the incentive. The survey next asked, “How often have you experienced with online payment platforms that a Bait and Switch approach is used?” The query received 11,554 responses with 30% indicating that Bait and Switch approach is used “very frequently”; 32% indicated it happens “sometimes” and 12% stated it “rarely” happens. Of the remaining respondents 15% indicated that they have “never” experienced this dark pattern and 11% of respondents did not give a clear response. To sum up, 62% users of online payment platforms surveyed experienced the Bait and Switch approach where a cashback was advertised to lure them but never actually paid after they signed up/ conducted the specified transaction.

41% users of online payment platforms surveyed admitted that they experienced the Forced Action approach

Transaction charges though UPI are meant to be free yet many complain that they are being charged by the online payment platforms or made to maintain a fixed balance in the wallet. Some have also reported on social media that they are forced to give access to their contact list on downloading the online payment apps. The survey asked, “How often have you experienced with online payment platforms that a Forced Action approach is used?” Out of 10,687 who responded to the query, 16% stated “very frequently”; 25% of respondents stated “sometimes” and 16% stated “rarely”. However, 28% of respondents stated “never” and 15% did not give a clear response. To sum up, 41% users of online payment platforms surveyed admitted that they experienced the Forced Action approach where either their funds in the online wallet up to a certain amount were blocked or they were forced to share their contact list to use the wallet payment service.

In summary, for all their advantages, consumers are indicating that online payment platforms do have certain dark pattern issues, some by design and others that are perceived. The survey brings to fore that 52% users of online payment platforms surveyed have experienced Hidden Charges associated with payment transactions and not disclosed upfront but debited from their account later. Other dark patterns have also been experienced by many online payment platform users. For instance, 67% users of online payment platforms surveyed have experienced Subscription Traps where once they added/ linked their bank account for UPI payments they found it hard to remove/ delink it. In addition, 62% users of online payment platforms surveyed have experienced Bait and Switch approach where a cashback was advertised to lure them but never actually paid after they signed up/ conducted the specified transaction. 41% of respondents have shared that they experienced the Forced Action approach where either their funds in the online wallet up to a certain amount were blocked or they were forced to share their contact list to use the wallet payment service. As the Indian digital payment ecosystem expands, there is need for regulators like the RBI and CCPA to step in and ensure that this ecosystem is free of dark patterns.

LocalCircles will escalate the findings of this study and the platform level dark pattern analysis to RBI and CCPA for their review and interventions.

Survey Demographics

The survey received over 45,000 responses from users of online payment platforms located in 376 districts of India. 67% respondents were men while 33% respondents were women. 43% respondents were from tier 1, 36% from tier 2 and 21% respondents were from tier 3, 4 and rural districts. The survey was conducted via the LocalCircles platform and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well