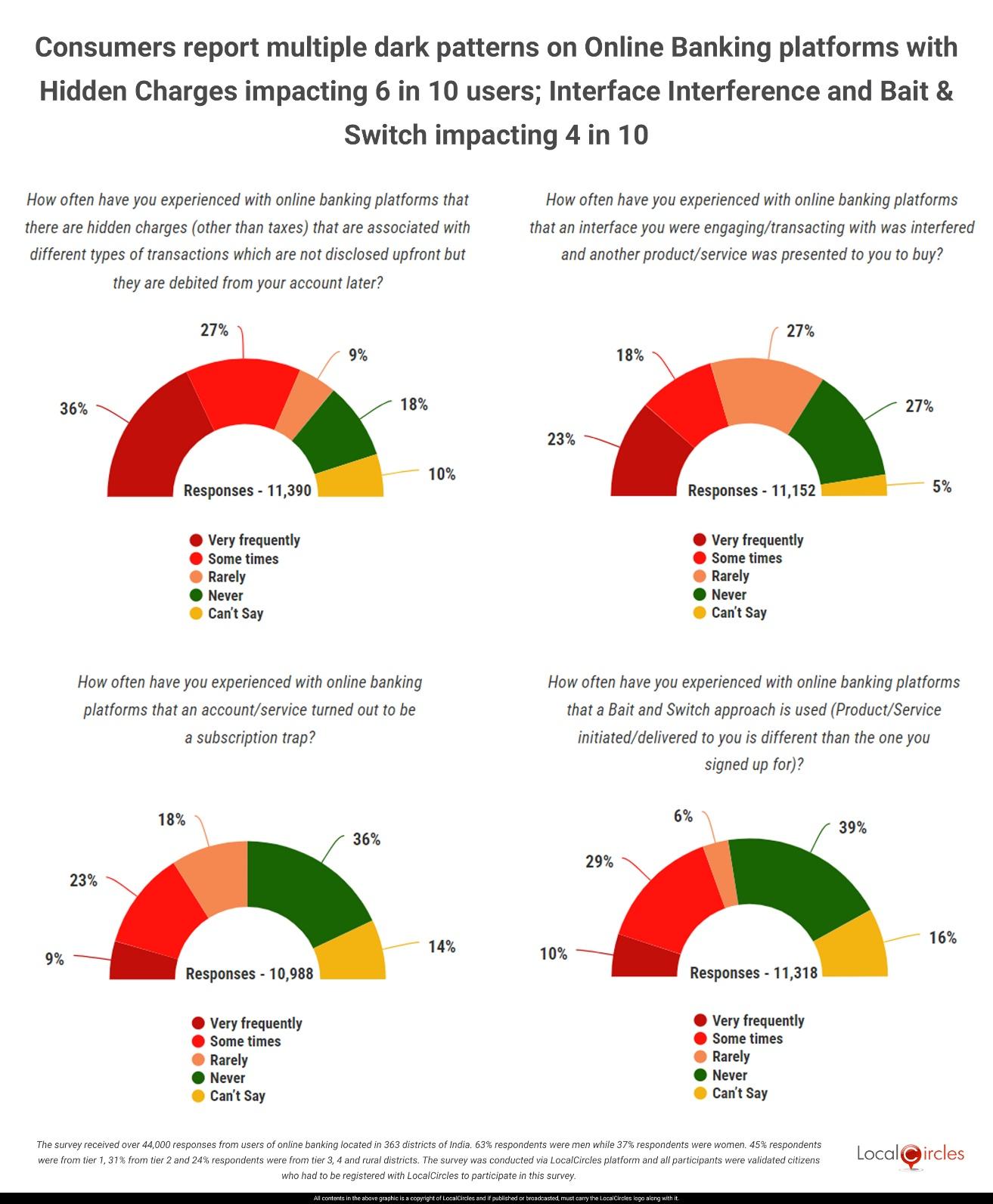

Consumers report multiple dark patterns on Online Banking platforms with Hidden Charges impacting 6 in 10 users; Interface Interference and Bait & Switch impacting 4 in 10 users

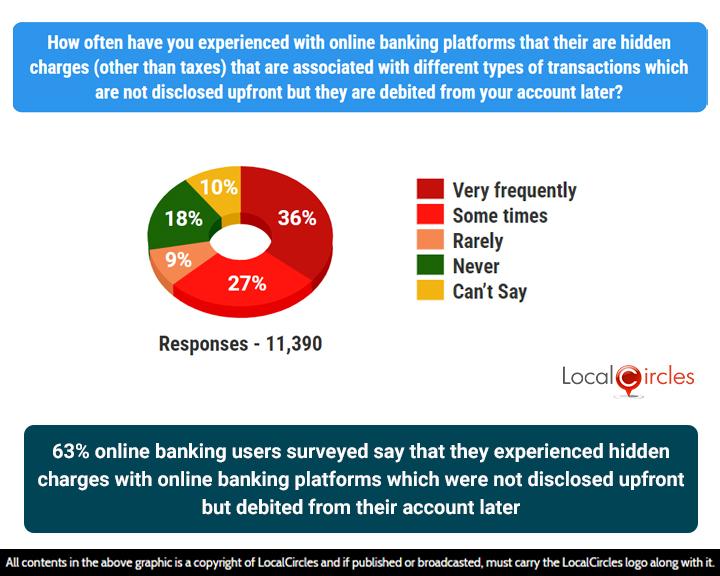

- ● 63% of respondents have experienced hidden charges which were not disclosed upfront but debited from their account later

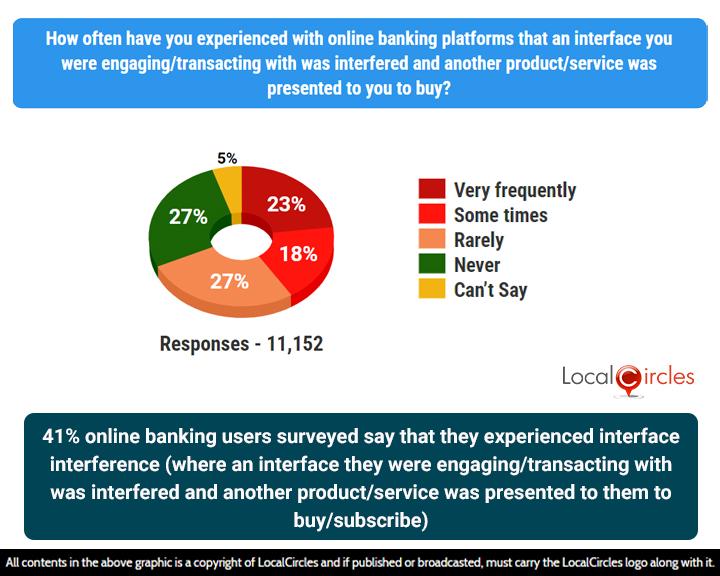

- ● 41% of online banking users surveyed say that they have experienced interface interference

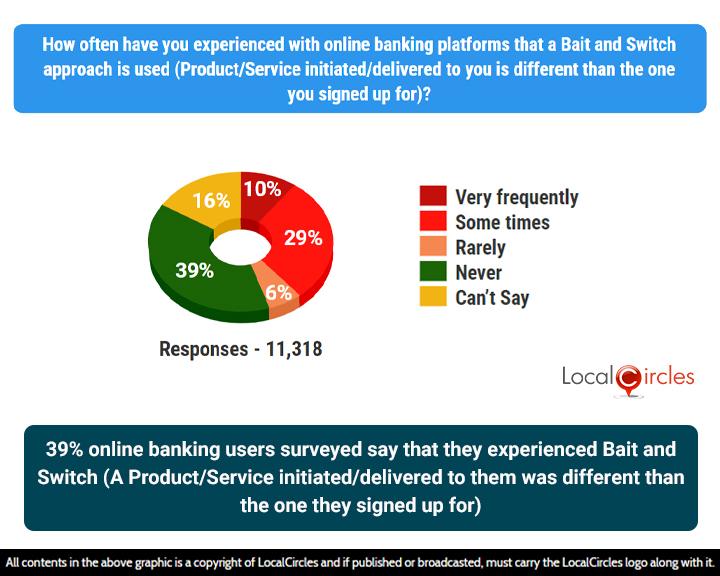

- ● 39% online banking users surveyed say that they have experienced Bait and Switch

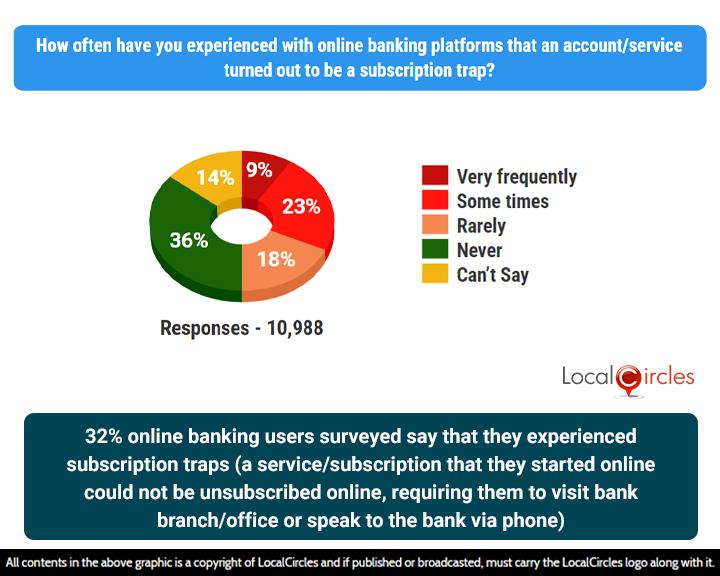

- ● 32% of online banking users surveyed say that they experienced subscription traps

March 19, 2024, New Delhi: Last year, the Reserve Bank of India (RBI) Deputy Governor M. Rajeshwar Rao had issued a warning about the presence of 'dark patterns' in the mis-selling of digital loans, where customers are misled into taking high-cost loans. Addressing an industry forum, he stressed, “Dark patterns are design interfaces and tactics used to trick users into desired behaviour such as availing high-cost short-term consumer credit masquerading as an instant loan. We must work hard, work smart and work together to protect customers from these threats to retain and strengthen their trust.” The RBI official highlighted that besides tricking users into taking high-cost, short-term consumer credit by posing as instant loans, mis-selling has transformed into a digital format involving deceptive design interfaces and tactics. Asking banks to enhance security measures to prevent cyber fraud in the technology-driven banking environment, Rao noted the rising instances of frauds and data breaches.

Dark patterns are everywhere, these are tricks used by applications and websites to make users do things they don’t want to. One such instance reported is of having to visit a bank branch offline to close a personal loan taken online. Making it hard for the consumer to close an account is a dark pattern. When taking personal loans, people take into account the rates of interest, the repayment capability, and the collection practices. In the online world, there could be dark patterns of not letting the potential customer understand what the rate actually implies in terms of cost. For instance, the customer may be given to understand that he/she is being given a cheap deal of 8% interest rate with no security, but on clicking acceptance, may end up with 36% interest rates with several terms and conditions. This is a classic case of bait and switch strategy.

Another dark pattern frequently reported is drip pricing or hidden charges where a user is told that they have been approved for a premium credit card by the bank only to find in their monthly bill that a fee in thousands is levied in the first billing cycle which they were never informed about. Had that been the case, there would have been a high likelihood of they not signing up.

Following several instances of complaints related to dark patterns in online banking, LocalCircles conducted a national survey to understand the magnitude of the issue. The survey received over 44,000 responses from users of online banking located in 363 districts of India. 63% respondents were men while 37% respondents were women. 45% respondents were from tier 1, 31% from tier 2 and 24% respondents were from tier 3, 4 and rural districts.

63% of online banking users surveyed say that they experienced drip pricing or hidden charges with online banking platforms which were not disclosed upfront but debited from their account later

Hidden banking charges are a sore point much discussed by consumers. Be it charges for annual credit card fee, money transfer charges or even charges for transactional SMS. Focusing on this sensitive issue, the survey asked “How often have you experienced with online banking platforms that there are hidden charges (other than taxes) that are associated with different types of transactions which are not disclosed upfront but they are debited from your account later?” Out of 11,390 who responded to this query, 36% indicated “frequently”; 27% indicated “sometimes” and 9% indicated “rarely”. Of the remaining respondents 18% stated “never” and 10% of respondents gave no clear response, opting for “can’t say”. To sum up, 63% of online banking users surveyed say that they experienced hidden charges with online banking platforms which were not disclosed upfront but debited from their account later.

41% of online banking users surveyed say that they have experienced interface interference

Many customers land up with products or services they may not have aspired for or sought. Via interface interference dark pattern deployment, some online banking platforms disrupt the consumer flow while they are conducting a transaction and drive them towards an additional product or service subscription/purchase. The survey asked “How often have you experienced with online banking platforms that an interface you were engaging/transacting with was interfered with and another product/service was presented to you to buy?” This query received 11,152 responses with 23% indicated it has happened “very frequently”; 18% of respondents indicated that it has happened “sometimes” and 27% indicated “rarely”. In addition, 27% of those surveyed indicated that they have “never” experienced interface interference and 5% of respondents indicated “can’t say”. To sum up, 41% of online banking users surveyed say that they have experienced interface interference (where an interface they were engaging/ transacting with was interfered with and another product/ service was presented to them to buy/subscribe).

32% of online banking users surveyed say that they experienced subscription traps

Subscription traps in online banking refers to deployment of a dark pattern where a consumer can easily sign up for a new product/service online but they are locked into a service such that they experience recurring charges and there are no available options online through which they can unsubscribe from the service as easily. Instead, they are made to visit a bank branch and go through paperwork and hassles to unsubscribe from the service. The survey next asked online banking customers, “How often have you experienced with online banking platforms that an account/service turned out to be a subscription trap (where a service that was started online required a visit to the branch/office or speaking to someone during business hours for closure thereby trying to discourage users from ending service/subscription)?” The query received 10,988 responses with 9% indicating “very frequently”, 23% stating “sometimes” and 18% indicating “rarely”. Of the remaining respondents, 36% stated “never” and 14% of respondents gave no clear answer, opting for “can’t say”. To sum up, 32% of online banking users surveyed say that they experienced subscription traps (a service/subscription that they started online could not be unsubscribed online, requiring them to visit bank branches/ offices or speak to the bank via phone.

39% online banking users surveyed say that they have experienced Bait and Switch

As reported in the case of some eCommerce platforms, in online banking too, many complaints have come to fore of being offered one product but receiving another product/service. One example that repeats here is that or deposits and loans where an attractive offer interest rate is advertised but when the transaction closes, the interest rate is different. The survey asked online banking users, “How often have you experienced with online banking platforms that a Bait and Switch approach is used (Product/Service initiated/delivered to you is different than the one you signed up for)?” This query received 11,318 responses with 10% indicating they have experienced Bait and Switch approach “very frequently”; 29% indicated it has happened “sometimes” and 6% of respondents indicated that it has happened “rarely”. Of the remaining respondents, 39% indicated that they have “never” experienced Bait and Switch approach and 16% gave no clear answer opting for “can’t say”. To sum up, 39% online banking users surveyed say that they have experienced Bait and Switch (A product/service initiated/delivered to them was different than the one they signed up for).

In summary, the survey confirms that fact that online banking in India has several dark patterns that need actions by the consumer and banking regulators. This survey confirms that 63% of online banking users surveyed have experienced hidden charges which were not disclosed upfront but debited from their account later. 41% of online banking users surveyed said that they have experienced interface interference (where an interface they were engaging/ transacting with was interfered with, and another product/ service was presented to them to buy/subscribe). 32% of online banking users surveyed say that they experienced subscription traps and 39% respondents confirmed that they have experienced Bait and Switch (a product/service initiated/delivered to them was different than the one they signed up for). These dark patterns lead to erosion of consumer trust in online banking and work against Government’s Digital India mission. While the RBI has recently drawn attention to the dark patterns in banking and CCPA, the consumer regulator has issued general dark pattern guidelines for all, it is now time for the consumer and banking regulators to move to action first by putting together guidelines for dark patterns in online banking and then initiating enforcement against all those platforms who choose to not comply.

Survey Demographics

The survey received over 44,000 responses from users of online banking located in 363 districts of India. 63% respondents were men while 37% respondents were women. 45% respondents were from tier 1, 31% from tier 2 and 24% respondents were from tier 3, 4 and rural districts. The survey was conducted via LocalCircles platform and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

Also Featured In:

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well