COVID-19 impact: Only 16% Startups and SMEs have cash to survive for more than 3 months

- • 42% are already out of funds or in shut down stage

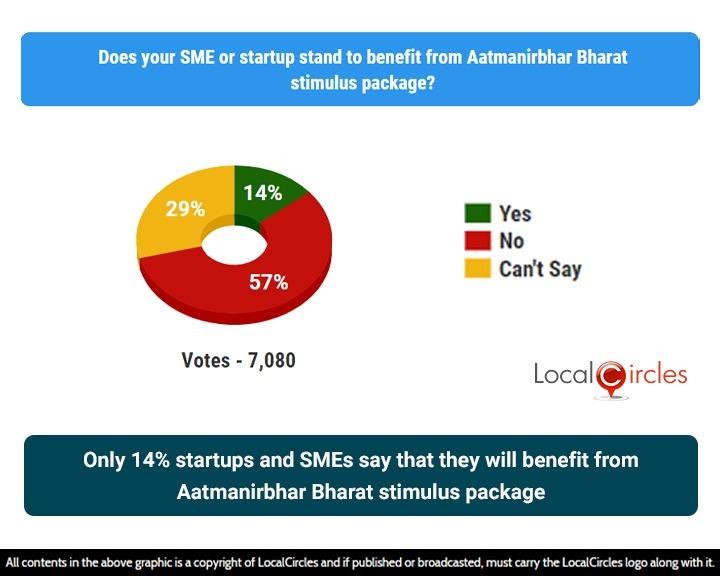

- • Only 14% startups/SMEs feel they will benefit from Aatmanirbhar Bharat stimulus

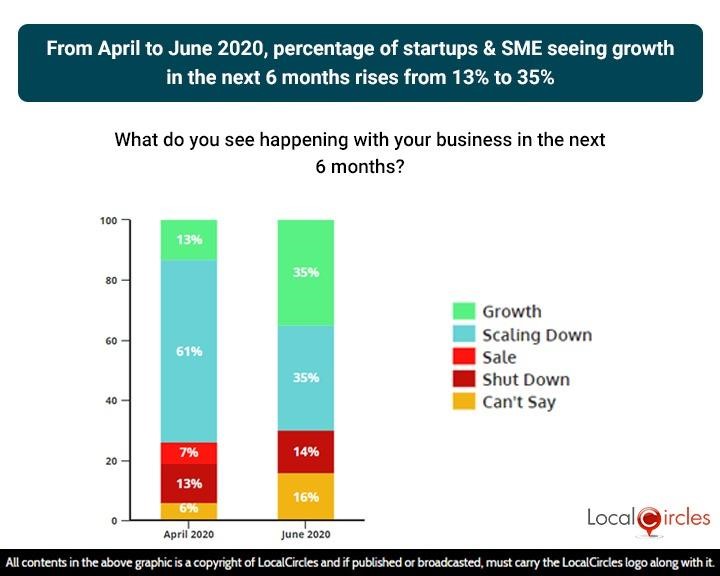

- • Only 35% startups and SMEs see growth happening in their business in the next 6 months, while rest see shutting down, scaling down or uncertainty

Only 16% Startups and SMEs have more than 3 months of runway; 80% of them cut costs in the last 3 months to come this far

June 15, 2020, New Delhi: The COVID-19 pandemic along with a health emergency, has brought with it many struggles for India’s startups and SMEs. Since the starting of the lockdown in the last week of March, startups & SMEs have seen a drastic fall in revenues and have been struggling to make ends meet. Some of the most well-funded startups of the country have announced layoffs & furloughs, and have been scampering to reduce cash burns in the race for survival.

LocalCircles conducted a survey to check the impact that COVID-19 pandemic and the following lockdown have had on the startups and SMEs of India. The 4-point survey received over 28,000 responses from startups, SMEs and entrepreneurs from across the country.

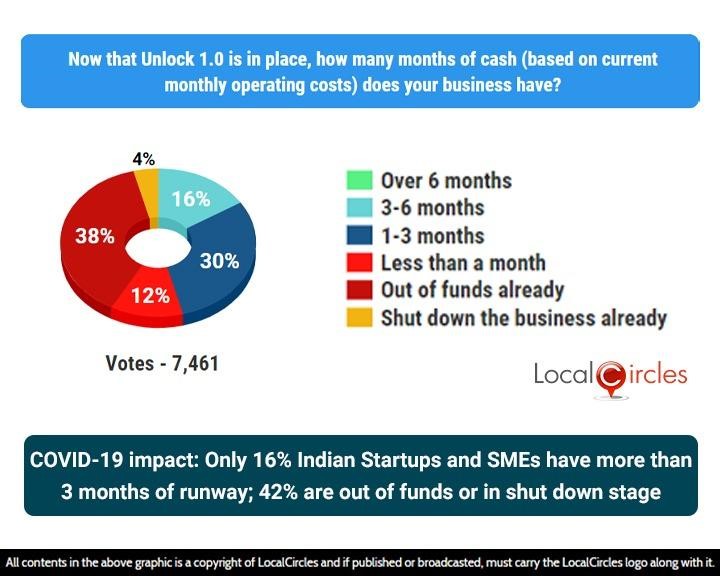

In the first question, startups and SMEs were asked now that Unlock 1.0 is in place, how many months of cash (based on current monthly operating costs) does their business have. 16% said the they have 3-6 months of cash left, 30% said they have 1-3 months of case left, 12% said they have less than a month’s worth of cash left while 38% said they are out of funds already. 4% also said that they have already shut down the business due to the lockdown effect.

COVID-19 Impact: Only 16% Indian Startups and SMEs have more than 3 months of runway; 42% are out of funds or in shut down stage

Many businesses have reported a revenue drop of more that 80-90% in the last 2 months making it hard for them to even sustain their business.

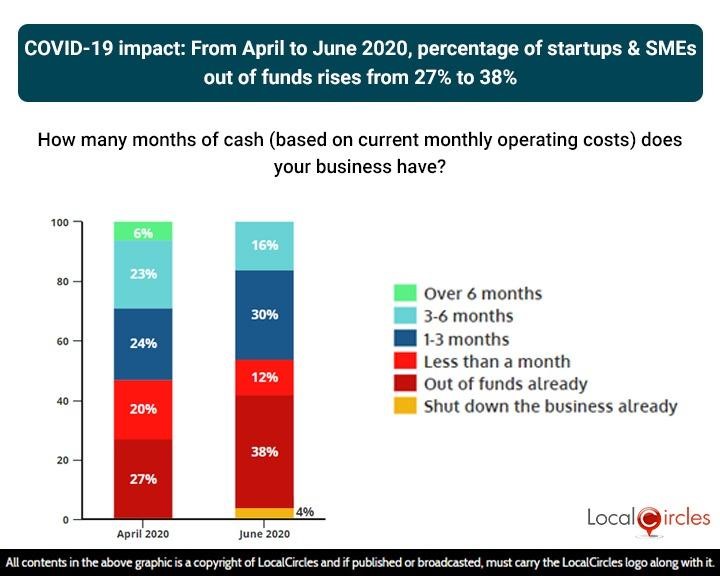

The comparison from April to June 2020, shows that percentage of startups & SMEs out of funds has risen from 27% to 42%, showing a worrisome situation.

COVID-19 Impact: From April to June 2020, percentage of startups & SMEs out of funds rises from 27% to 38%

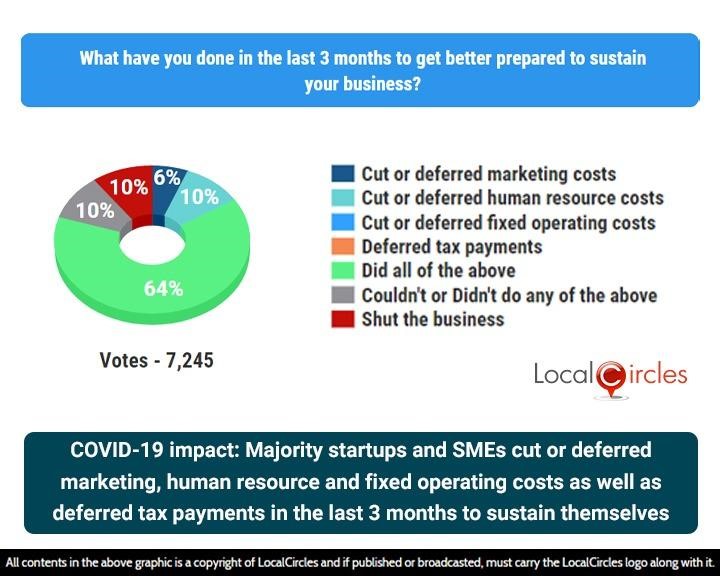

Startups and SMEs were also asked what they have done in the last 3 months to get better prepared to sustain their business. 6% said they have cut or deferred only marketing costs while 10% said they have cut or deferred human resource costs. 64% said they have cut or deferred marketing costs, cut or deferred human resource costs, cut or deferred fixed operating costs as well as deferred tax payments. 10% said they couldn't or didn't do any of the above while and 10% said that they have already shut their business.

COVID-19 Impact: Majority startups and SMEs cut or deferred marketing, human resource and fixed operating costs as well as deferred tax payments in the last 3 months

COVID-19 impact: Majority startups and SMEs cut or deferred marketing, human resource and fixed operating costs as well as deferred tax payments in the last 3 months to sustain themselves

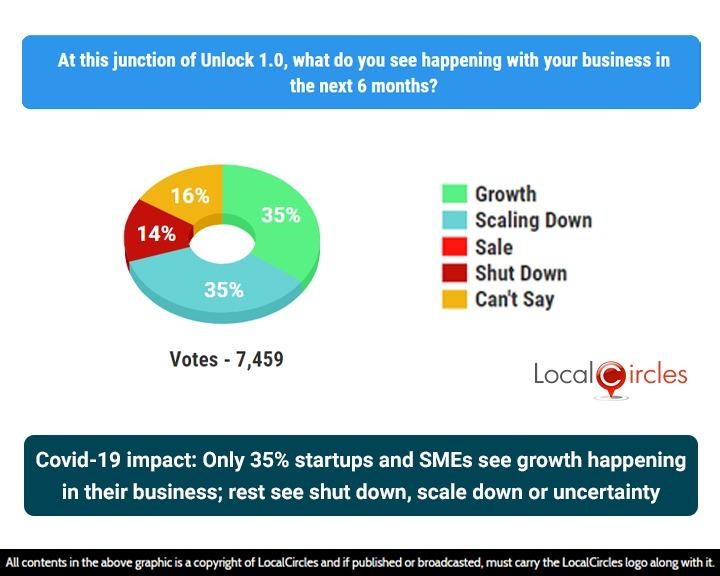

The third question asked at this junction of Unlock 1.0, what do they see happening with their business in the next 6 months. 35% they see growth while 35% said they would be scaling down. 14% said they see their business getting shut down while 16% said they were quite unsure of the future.

COVID-19 Impact: Only 35% startups and SMEs see growth happening in their business; rest see shut down, scale down or uncertainty

This means that only 35% startups and SMEs see growth happening in their business in the next 6 months, while rest see shutting down, scaling down or uncertainty. Many companies have been trying to raise funds in the last few months but have not been able to do so due to the reduced interest of investors and liquidity drying up.

The comparison between April and June 2020, shows that the percentage of startups & SMEs seeing growth in the next 6 months has risen from 13% to 35%, indicating that some startups have found new revenue streams or markets and therefore 35% now see growth. While this may be the silver lining, majority startups and SMEs still expect scaling down or shut down in the next 6 months indicating difficult times. The average daily cases of COVID-19 have risen from 2000 a day in late April to 11,000+ a day now.

From April to June 2020, percentage of startups and SME seeing growth in the next 6 months rises from 13% to 35%

When asked if their SME or startup stands to benefit from Aatmanirbhar Bharat stimulus package announced by Government of India over a month ago, only 14% said ‘yes’ while a large 57% said ‘no’. 29% were however unsure about it.

Only 14% startups and SMEs say that they will benefit from Aatmanirbhar Bharat stimulus package

The cabinet approved Rs 3 lakh crore emergency credit line to the MSME community to help them sail through this tough time. But a large number of startups might not be able to avail these benefits under the Atmanirbhar Bharat scheme even if they are registered as MSMEs. This is because a startup needs to have existing debt/loans on their books to qualify, but most Startups usually opt for VC funding, which makes them ineligible for this Government scheme.

Going into the year 2020, the situation was already difficult for startups and SMEs due to the economic slowdown. The situation has drastically deteriorated with COVID-19 outbreak and lockdown as international and domestic demand or revenues as well as funding has dried up for most sectors. While the Atmanirbhar Bharat stimulus has big numbers, how quickly startups and SMEs can see money in the bank remains the big question. For most of them, they can’t afford to chase the paper work and loans/funds for months and still sustain their business. The need of the hour was and is, assistance that reaches bank accounts fast and fast in the context of startups and SMEs means now as 42% of them are already in shut down or out of funds status.

Survey Demographics

28,000+ responses were received from 8400+ startups, SMEs and entrepreneurs located across India. They survey was conducted via LocalCircles platform and all participants are validated users who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

Akshay Gupta - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.