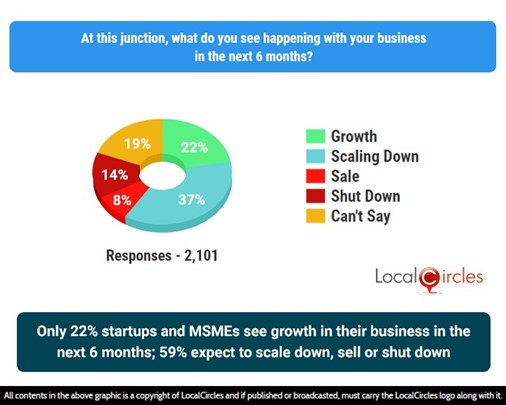

Impact of COVID 2nd wave: 59% Startups and MSMEs in India likely to scale down, shut down or sell themselves this year

- ● Only 22% Startups & MSMEs have more than 3-months runway; 41% are out of funds or have less than 1 month of funds left

- ● 49% Startups and MSMEs plan to reduce employee compensation and benefits costs by July

- ● MSMEs wants relaxations on Government and PSU Contracts while Startups want Government Procurement to be made easier

May 27, 2021, New Delhi: Startups and MSMEs have been in the race for survival, especially since the onset of the COVID-19 outbreak in 2020. India observed the countrywide lockdown from March 24th till September 2020, and the unlocking post that then the imposition of lockdown-like restrictions from April 2021. India’s economy had just started to recover from September 2020 from the 1st wave of COVID-19. However, 2nd wave of COVID-19, related lockdowns and curfews and their concomitant impact on the economy have once again brought along very high levels of uncertainty, struggles and challenges for Startups and MSMEs to find growth in their business and gather the necessary funds and capital to run their operations.

LocalCircles has been collecting inputs from Startups and MSMEs across India to understand and escalate the challenges they are facing with the ongoing pandemic. The motive of the survey is to ascertain small businesses’ current state of affairs, preparedness, and remaining cash flow to run their operation. It also gathered their perception on availing time extension on all Government contracts so they can deliver to terms without incurring liquidated damages. The survey received more than 11,000 responses from over 6,000 Startups and MSMEs located in 171 districts of India.

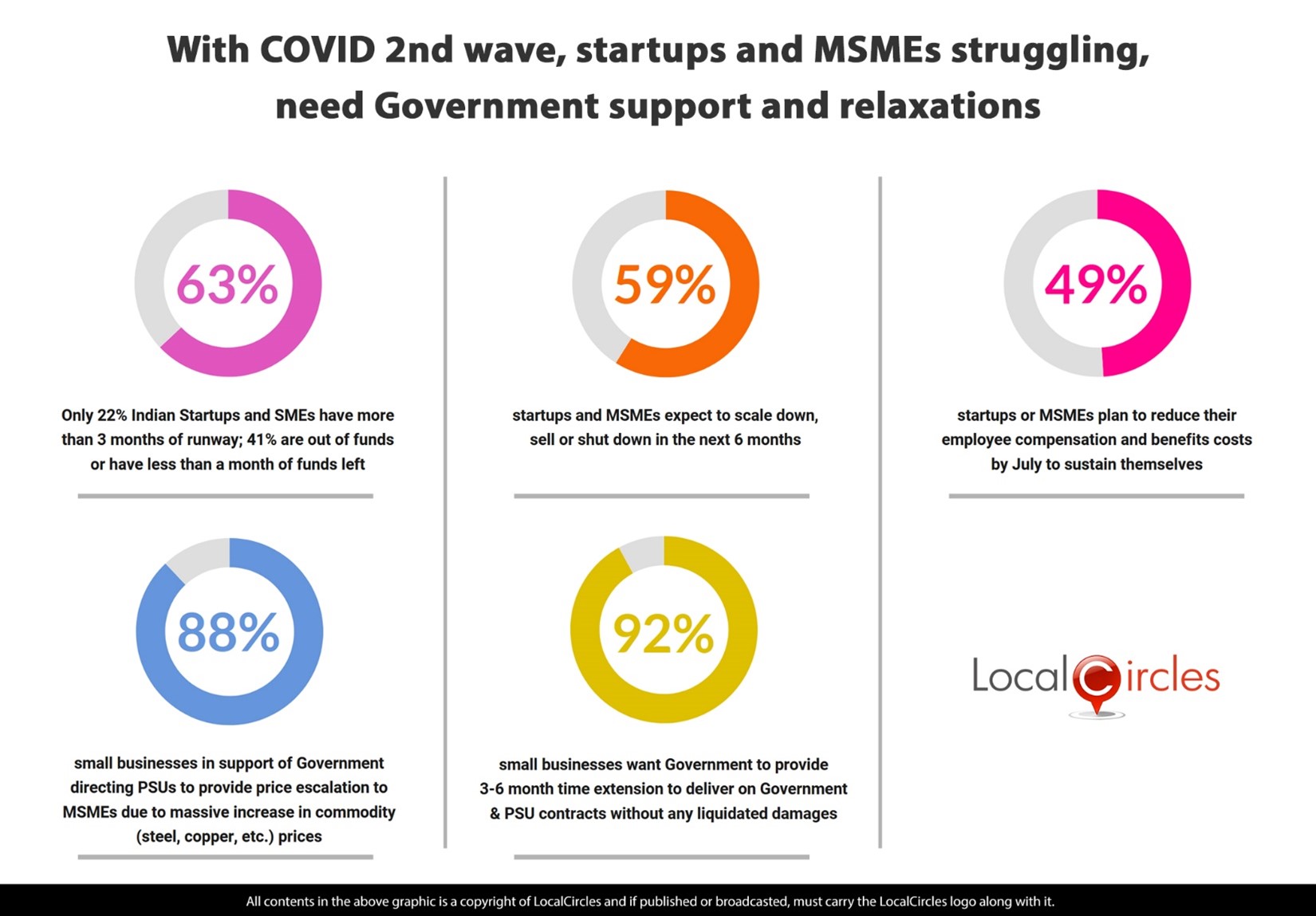

Only 22% Indian Startups and MSMEs have over 3-months runway; 41% are either out of funds or have less than 1 month of funds left

The first question asked small businesses about the months of cash (based on current monthly operating costs) they have on hand. In response, 33% of small businesses said they have only less than 1 month of cash remaining, whereas 8% are already out of funds. Only 22% have more than 3 months of runway, 11% have it for over 6 months, and 37% have funds for 1-3 months. This question in the survey received 2,140 responses.

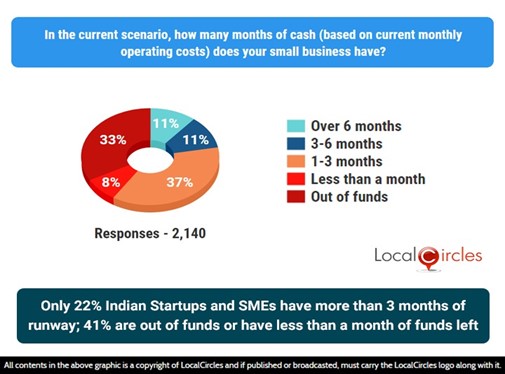

49% Startups and MSMEs plan to reduce their Employee Compensation and Benefits Costs by July to sustain themselves

When Startups and MSMEs were asked what they have done in the last 2 months, or plan to do in the next 2 months, to get better prepared to sustain their business, 7% said they would (1) reduce advertising, marketing and new initiative costs; 9% said they would (2) reduce employee compensation and benefits costs, and 13% said to (3) reduce other fixed operational costs. Breaking down the poll, 7% chose ‘1 & 2’ options from their aforementioned business operation, 13% chose ‘2 & 3’, and 33% chose “1, 2 & 3” options. There were also 18% of small businesses who said they did not need to do any of the above. Per aggregate response suggests that 49% of Startups or MSMEs plan to reduce their employee compensation and benefits costs by July to sustain themselves. This question in the survey received 2,083 responses.

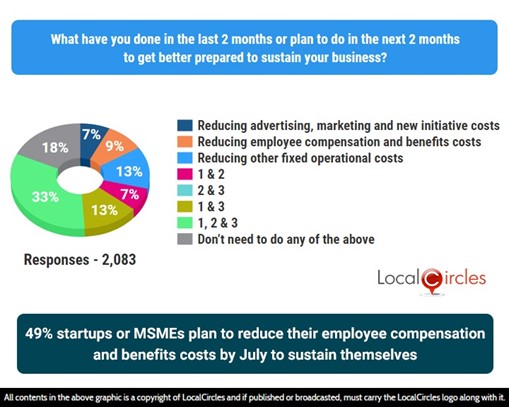

Only 22% Startups and MSMEs see growth in their business in the next 6 months; 59% expect to scale down, sell off, or shut down

The following question asked Startups and MSMEs about where they see their business future in the next 6 months given the impact of 2nd wave of COVID outbreak in the country. In response, 59% of small businesses expect to scale down, or sell off, or shut down. Of which, 37% said they will Scale Down their operation, 14% said they might Shut Down, whereas, 8% would Sale off their business in the next 6 months. 19% did not have an opinion. Only 22% of Startups and MSMEs see growth in their business during this period. It is likely that the ones that see growth are involved in online sales and services, health and FMCG or digital payments sector many of which have seen an uptick in demand during the pandemic. This question in the survey received 2,101 responses.

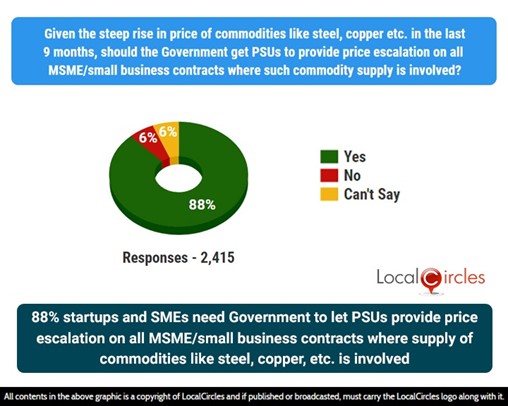

88% small businesses need Government to let PSUs provide price escalation on all MSME/small business contracts where supply of commodities like steel, copper, etc., is involved

Last year, the Union Government approved an INR 3 lakh crore emergency credit line, brought in the Atmanirbhar Bharat Scheme, and several other relaxations aimed at providing relief to MSMEs of the country. There were, however, teething issues that small businesses faced to avail these benefits and many didn’t’ have existing debt or loans on their books to qualify under the Atmanirbhar Bharat scheme. Many MSMEs specifically outlined how they have been struggling with rising prices of commodities like steel and copper since mid-2020. Many of those working with Government and the Public Sector Undertaking (PSU) Units are struggling to service contracts as prices have risen far beyond projections. One of the key asks that MSMEs have listed out are the need for price adjustment/escalation provided to them on Government and PSU contracts. Similarly, last year due to the lockdown, the Government had offered an extended time window of 3-6 months to MSMEs on Government and PSU contracts so they don’t face liquidated damages due to COVID-19 lockdown/curfew related delays. Many of the MSME want the same benefit extended this year.

When asked Startups and SMEs if the Government should get PSUs to provide price escalation on all MSME/Small business contracts where such commodity supply is involved, 88% said yes. Only 6% said no, and 6% did not have an opinion. This question in the survey received 2,415 responses.

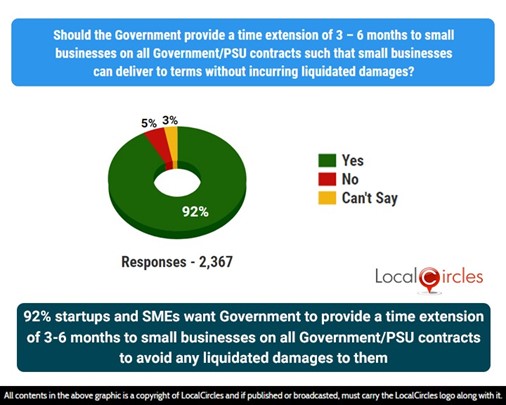

92% small businesses want Government to provide a time extension of 3-6 months on all Government/PSU contracts to avoid any liquidated damages to them

Many small businesses have reported a revenue drop since the 2nd wave of COVID-19. Many have been forced to delay any Government or PSU works they have undertaken and per contract agreed to deliver on a certain date due to lack of labour and work force availability and the lockdown and curfew restrictions. With the pandemic reaching smaller towns and rural areas this time, the labour has migrated away making it very difficult for MSMEs to deliver to commitments. To understand what could be done so they don’t have to incur the cost as liquidated damages against the delay in work due to the pandemic, the next question sought to know if the time extension of 3-6 months on all Government/PSU contracts should be provided to small businesses. In response, the majority of 92% said yes. Only 5% said no, and 3% did not have an opinion. This question in the survey received 2,367 responses.

When startups specifically were asked about what is it they need to sustain their operations, funding and revenue opportunities. Few areas that came out clearly via discussions and feedback exercises. Startups want the Government to permit deployment of Corporate Social Responsibility (CSR) funds into Social Impact Startups. The second wave of COVID has made many realise the need for more Startups that are socially oriented in areas like emergency assistance, community engagement and mobilisation, health equipment support, etc. These startups have never been funded by traditional venture capitalists in India and hence largely non-existent. Enabling CSR funds to become available will enable many Startups that are in early stages to scale up. Similarly, it continues to be extremely difficult for Startups to work with Central and State Governments and District Administrations in India and if Government Procurement and Payment norms are made easier, Startups could engage with Government bodies and provide their products and services to the Government with the opening up of a new channel for them.

Along with the above the needs of the hour according to small businesses is for the Government to be more empathetic to their pain and challenges. Providing timely relaxations on direct and indirect tax is another critical need of the hour. At a time when almost all major states across India have imposed lockdowns and curfews, it is just not practically possible for most small businesses to make their tax payments and file their returns. A time extension will go a long way and enable them to chart a recovery and sustainment plan. By doing this, the Government would be postponing some of its revenue collection by a few months but if half of the small businesses actually end up shutting shop the loss would be much bigger and longer term.

As always, LocalCircles will be escalating the findings of this survey with the key Central Government Ministries of Finance, Commerce and MSME so they are aware of the situation on ground and necessary actions can be considered to provide the much-needed support.

Survey Demographics

The survey received more than 11,000 responses from over 6,000 startups and MSMEs located in 171 districts of India. The survey was conducted via LocalCircles platform and all participants were validated participants who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.