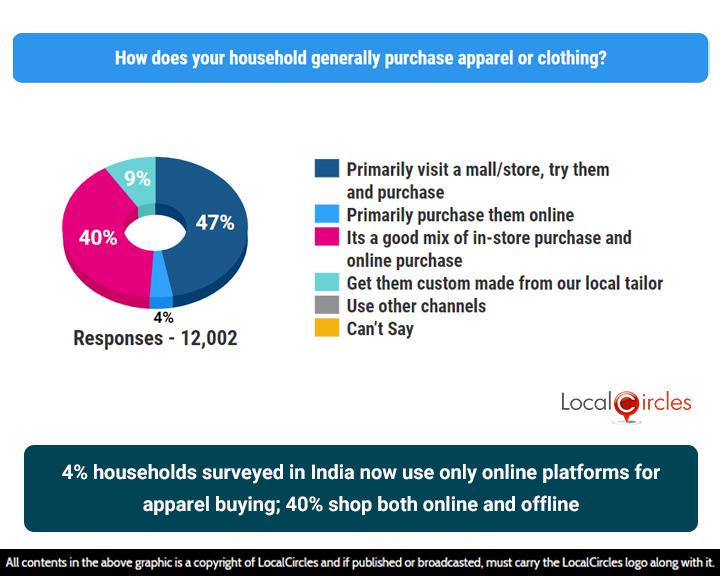

4% households in India now use eCommerce as their exclusive channel to buy apparel; 40% shop both online and offline for it

- ● 47% of those surveyed indicating that they “primarily visit a mall/store, try them and purchase”

- ● 40% indicated that their shopping is “a good mix of in-store purchase and online purchase”

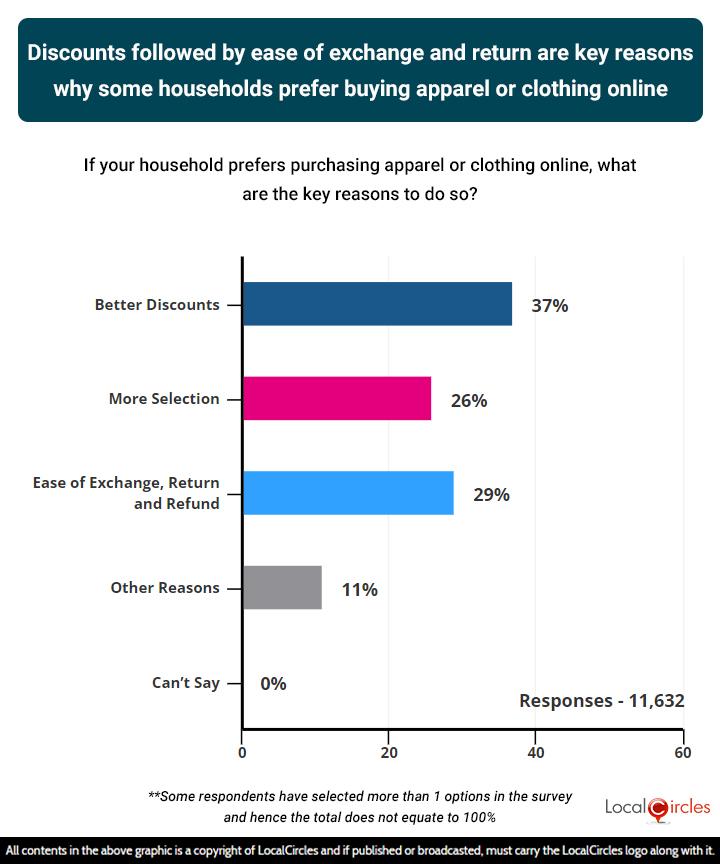

- ● 37% of those who shop online feel eCommerce platforms offer “better discount”

- ● 29% prefer online shopping for “ease of exchange, return and refund”; 26% indicated “more selection”

April 22, 2024, New Delhi: Indian domestic textile and apparel industry contributes nearly 2% of India’s GDP and accounts for 14% of industrial production, 27% of the country’s foreign exchange inflows and 13% of country’s export earnings, the Indian Chamber of Commerce (ICC), states in its report titled ‘Apparel Consumption Trends in India’. The total Indian apparel consumption expenditure is expected to grow to INR 9.35 Lac Crores or USD 105.5 billion in 2024. “The Indian middle-class consumers are value conscious and at the same time want fashionable clothes too. They seek quality and design at the best price. Therefore, the Indian middle-class consumers are creating an opportunity which needs to be captured with ‘economy and value fashion’,” states the report. Among the various segments in the market, women's apparel holds the largest share, with a market volume of US$51.05 billion in 2024, according to data analytics platform Statista.

The market reports stress that while functionality continues to increase consumption, the urban consumer's desire to be more fashionable overrides all other factors boosting sales for apparel retailers and brands. While, considering apparel as a functional purchase, the urban consumers also see apparel as a form of self-expression. They consider it as a reflection of their personality and status. To remain up to date with the latest fashion trends, urban consumers get influenced by their social circles, Instagram feeds and Facebook updates. Therefore, more and more urban consumers, especially the young are buying apparel based on latest fashion trends and styles as well as based on aspirations. The urban GenZ especially, are allured by brands and retailers that rapidly translate catwalk fashion trends to their stores.

The increasing access to digital devices and internet is enabling masses to have an online shopping experience irrespective of whether they are living in urban or rural areas. The online shopping experience has started to provide a rich, immersive, and personalised shopping experience to a customer, and this is a major reason which is driving growth. However, as compared to the overall apparel sales, the online sales still continue to be a high single digit percentage. To understand the consumer preferences better, LocalCircles conducted a national study “How India buys apparel”. The study received over 35,000 responses from consumers located in 323 districts of India. 61% were men while 39% respondents were women. 43% respondents were from tier 1, 33% from tier 2 and 24% respondents were from tier 3, 4 & rural districts.

4% households surveyed in India now use only online platforms for apparel buying; 40% shop both online and offline

The study first asked consumers, “How does your household generally purchase apparel or clothing?” Over 12,000 responded to this query with 47% of those surveyed indicating that they “primarily visit a mall/store, try them and purchase”; 40% indicated that their shopping is “a good mix of in-store purchase and online purchase”; 4% indicated that they “primarily purchase them online” and 9% shared that they “get them custom made from our local tailor”. In all, only 4% indicated that they no longer visit a store or mall to get new apparel or clothing but rely on online shopping only for clothes.

Discounts followed by ease of exchange and return are key reasons why some households prefer buying apparel or clothing online

The study next sought to find out consumer views on what are the advantages of store shopping and online shopping when it comes to apparels and clothing. It asked consumers, “If your household prefers purchasing apparel or clothing online, what are the key reasons to do so?” This query received 11,632 responses with some indicating more than one reason. The prime reason indicated by 37% of respondents was “better discount”; 29% cited “ease of exchange, return and refund”; 26% indicated “more selection” or choice; 11% stated other reasons beside those indicated above. In all, discounts followed by ease of exchange and return are key reasons why some households prefer buying apparel or clothing online.

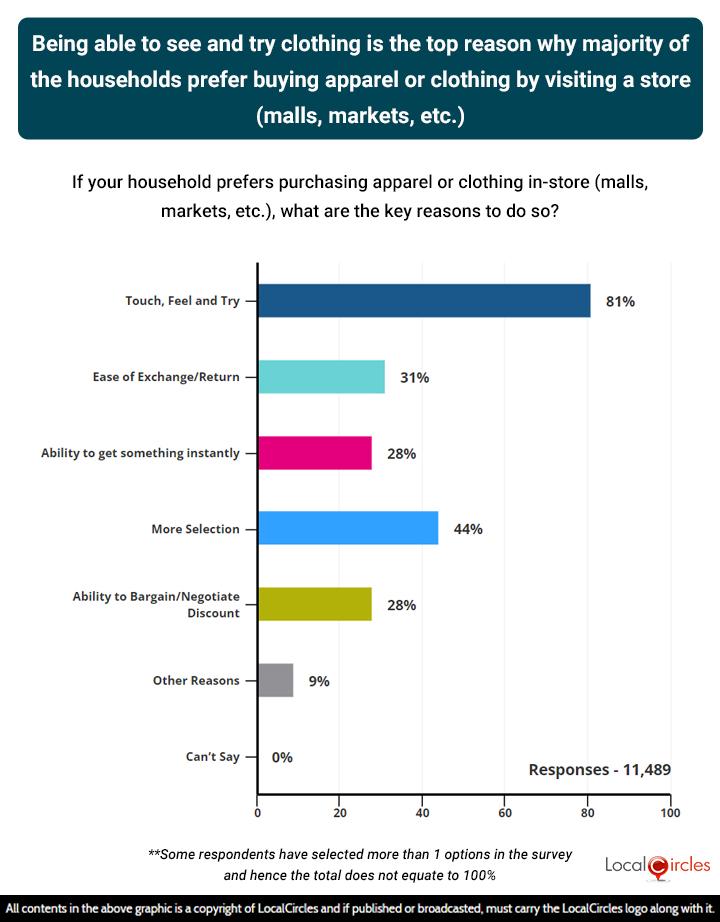

81% of respondents indicated that they prefer to shop in stores as there is a “touch, feel and try” facility in most places

Next, the study sought to find out “what are the key reasons” why your household prefers purchasing apparel or clothing in-store (malls, markets, etc.). This query received 11,489 responses with some citing more than one reason. The biggest reason as cited by 81% of respondents was “touch, feel and try” facility in most stores; 44% cited “more selection”; 33% indicated “ease of exchange/ return”; 28% indicated “ability to get something instantly”; 28% stated “ability to bargain/ negotiate discount” and 9% stated “other reasons”.

In summary, the study result shows that while 4% consumers now only shop online for clothing, 47% are shopping only via stores and markets. Another 40% are shopping for apparels both online and offline. What the study finds is that though the pandemic led to increased adoption of buying apparel online, once again the physical stores/ markets are being preferred by people for buying clothes. 81% of respondents said the key reasons for preferring to buy clothes online is the ability to touch, feel and try them before finalizing their purchase. Other major reasons are ability to make a quick buy and take it home, ease of exchange and return or in all convenience in many respects. In community discussions, many consumers indicated that they purchase products they go online for repeat purchases of branded products as the fit and quality are already known, and they tend to make first time purchases at a store. Whether the online platforms that sell clothing online be able to deliver faster and provide a better buying and return experience will determine whether more consumers make online platforms as their primary channel to buy clothing. With convenience fee to order online and other charges like delivery and in some cases even a return fee being levied by some platforms, there currently are barriers that work against the growth of the apparel industry online. Unless the discounts offered stay high which they have been in the last few years, there is a high chance that online apparel buying will stagnate or see slow growth in India.

Survey Demographics

The study received over 35,000 responses from consumers located in 323 districts of India. 61% were men while 39% respondents were women. 43% respondents were from tier 1, 33% from tier 2 and 24% respondents were from tier 3, 4 & rural districts. The study was conducted via LocalCircles platform and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.

Enter your email & mobile number and we will send you the instructions.

Note - The email can sometime gets delivered to the spam folder, so the instruction will be send to your mobile as well